We sat down with Hong Kong’s longest-serving Finance Secretary The Hon John Tsang, one of the must-see speakers at Hong Kong’s RISE Conference, to learn more about his thoughts on his city’s startup scene.

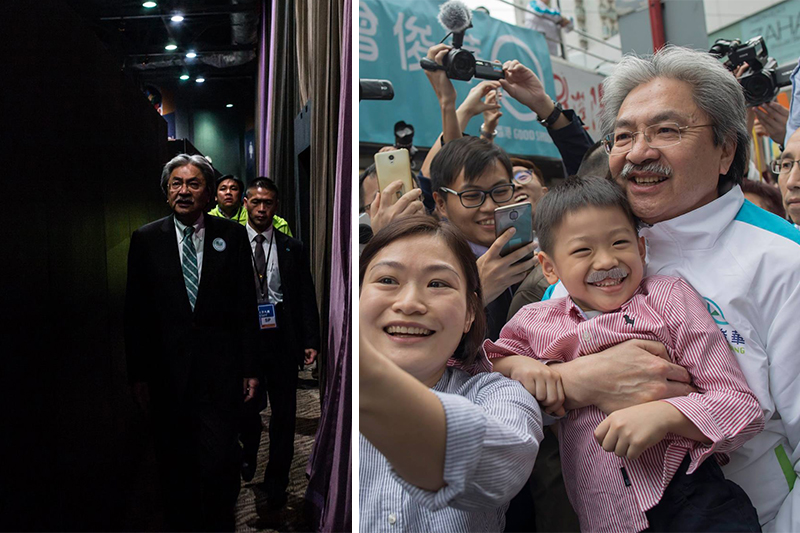

With his trademark moustache and fatherly persona, the Hon John Tsang, or ‘Mr Pringles’ as he’s affectionately known by many, is widely regarded to have been the people’s choice for Hong Kong’s Chief Executive in the elections of 2017, and from his entrance at this year’s RISE Conference, it’s clear that public interest has not waned since he lost that contest. Our ten or so metre walk through the Media Village at Hong Kong’s preeminent tech event is punctuated by a great many handshakes and nods of appreciation from both fellow speakers and eager onlookers. By the time we reach our assigned interview booth, it’s clear that we’re in the company of not just any celebrity, but a long-loved and much respected public figure.

Born in Hong Kong in 1951, then raised and educated in the US, John Tsang worked in the Hong Kong government for over thirty years in roles including Assistant District Officer for Shatin, Private Secretary to the city’s last colonial Governor Chris Patten, and, most recently, Financial Secretary in both the Donald Tsang and Leung Chun-ying administration. He is, in fact, the city’s longest serving Financial Secretary, having assumed the position in 2007 and relinquished it in 2017, and is credited with guiding the city’s finance industry through the 2008 global financial crisis. While some have questioned his conservative approach in handling Hong Kong’s fiscal reserves, he is generally well-regarded and led the opinion polls by a large margin during his 2017 Chief Executive candidacy.

One thing that has remained a constant throughout his long career has been his enduring support for the startup community in Hong Kong. During his time as the city’s financial secretary, the Harvard alum pumped a staggering HKD 560 million into expanding the Hong Kong Science Park and also launched a HKD 260 million innovations and technology venture fund with the aim of ‘carefully building a tech-based ecosystem that connects stakeholders, nurtures talent, facilitates collaboration, and drives innovation to commercialisation.’ And, in as recently as June of this year, he joined the fintech-focused merchant bank Ion Pacific in an advisory role as vice-chairman.

On his love for startups, John Tsang tells us, “Many startups are actually started by young people, and, for some of them, it’s perhaps the first thing they’ve ever done. And that’s exciting. The passion that young people have is exciting. And then there’s this whole area of startups that’s not just limited to young people. You see a lot of older people, people in the middle of their career, or even those in retirement, coming up in the world. As our life expectancy increases, people are looking forward to living a much longer, better and more fulfilled life.”

In terms of location, John Tsang’s regards Hong Kong as being an exciting place for startups, in particular for those that have a physical product. “Given its proximity to the Pearl River Delta, Hong Kong’s physical location is ideal. In this area you can get prototypes made overnight.” He adds, “I don’t think any neighbourhood or place is better in terms of living conditions for people coming from overseas.”

It was back in March this year that John Tsang first announced plans to set up a platform to help budding entrepreneurs and promising startups get their businesses off the ground. Whilst little has been said since the initial announcement, John Tsang makes it clear during our meeting that the priority with regard to helping startups should be on mentorship. “Funds are plentiful. As Financial Secretary, I know that funds are plentiful. As long as a startup packages and prepares themselves properly and presents a good product, then they should have no difficulty in getting the right kind of funding. I think money is secondary to mentorship, in terms of business development. I’ve talked to a lot of people that work in startups and many of them have no idea what cash flow is. Many haven’t even seen a balance sheet. Where they fail is not in ideas but in the development of the business model. So, I think that rather than throw money in their direction, we should help them gain access to different professions so that they can get a much better, well rounded sense of how the business will operate.”

In the hour or two preceding our meeting at RISE, Chief Executive Carrie Lam stood on the main stage at the tech conference discussing Hong Kong’s “limited talent pool”. When asked if he was of the same opinion, John Tsang replied, “That sort of thinking is traditional thinking. Nowadays, we live in a connected world where everything is just a click away, so I don’t think there is any such thing as a geographical barrier. Why do we limit ourselves to just our population of seven million? In one of my companies, we have talents from Serbia, from Vietnam, as well as talents from Hong Kong, so I think it’s too traditional to limit ourselves just to our physical location. Talking to someone in the New Territories through Whatsapp is just the same as talking to someone in Russia, so it’s best to expand our minds a little bit and get away from that kind of thinking.”

To end, we touch on the rather hot top of mobile payment platforms in the city. A recent survey conducted by the Hong Kong Productivity Council found that only 29 percent of respondents had ever paid for something using their smartphone, with 57 percent saying that they would not choose to use mobile payment systems, meaning that Hong Kong lags behind countries like China where a whopping 98 percent of the population are understood to have replaced cash with mobile payment systems.

Unconcerned, John Tsang replied, “I think we need to find a balance. The Octopus Card was something that was here long before anything else, and people in Hong Kong are loyal customers to it as it solves so many of our everyday needs. They may use other instruments when they go to the Mainland, but they just don’t see the need here. I know that many financial institutions are prepared to adapt, but they are looking for demand from consumers. If the consumer demands it, it will naturally come out.”

Related Articles

Logivan: on the ‘RISE’ to recognition