It’s time to take control of your personal finances, and with the recent launch of Hong Kong FinTech app gini, you’ll soon find that it’s never been easier, or more rewarding.

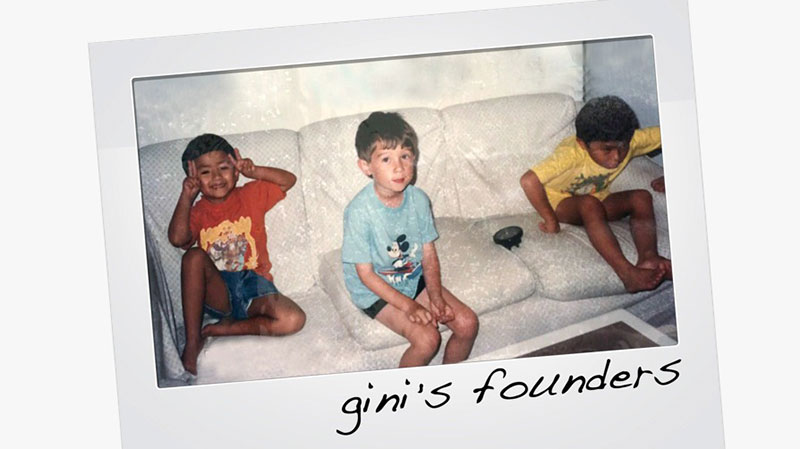

Founded in October 2016 by former Citibank Vice President Ray Wyand and his cousins Victor and Calvin Lang, gini is Hong Kong’s first all-in-one personal finance management application. It works by linking all your bank accounts onto one single app, making it easy for you to track your finances, save money and gain rewards based on your spending habits and preferences – think of it as your own personal genie granting you wishes and bestowing you with gifts. “Hong Kong has one of the highest Gini coefficients in the world, so we wanted to create a B2C app that lowered the Gini-coefficient by decreasing the distance between the normal people, and those with lots of money. We want to give normal people the opportunity to save more money,” explains co-founder and COO Victor Lang.

“People in Hong Kong are missing the tools to manage their finances properly,” begins Victor, when explaining what gini is all about. “In the US and Europe, there is a huge range of personal finance apps to choose from, but nothing like that currently exists in Hong Kong.” In a survey recently conducted by gini titled Millennials’ Spending and Saving Habits, results showed found that nearly half (43%) of those born in the ‘90s save less than 10% of their income every month, whilst an astonishing 1 in 4 people born in the ‘90s (26%) spend every penny that they own in that same timeframe. “In Cantonese, there’s a term for them, ‘moonlight clans’, every month they just spend it all,” continues Victor. The survey also found that a third of those born in the ‘80s and ‘90s (32%) have no idea or recollection of what they are spending their money on.

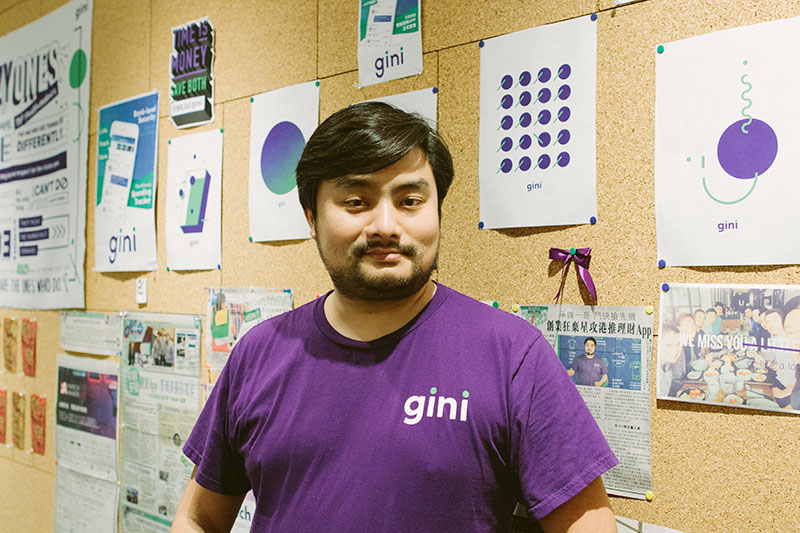

Spotting a gap in the market, the boys quickly set about building Hong Kong’s first personal finance app, working out of the cramped living room of Ray and Calvin’s Hong Kong apartment in the early weeks. By October 2016, they managed to rent a couple of desks squished in at the backend corner of a friend’s company office space. As CEO, Ray is the man in charge. “He’s really good at big-picture thinking,” remarks Victor. “He’s like the chess player of the team – always thinking about what our business will be like in 6 months time, and how we can get there. I’m less strategic, more action. Once someone gives me a direction, I’ll make sure that I achieve the task at hand in any way possible. And as CPO, Calvin is the technical person. He spends a lot of his time liaising between Ray and me and the tech team.”

gini officially launched the beta version of its app in March 2018. Its main feature is the fact that it links all your bank accounts and credit cards in one place, streamlining all your expenses on one clean and intuitive dashboard. There’s also a great categorisation feature that helps users do some basic analysis on their own spending habits. Victor explains, “there are a lot of problems with the transaction data we get from bank statements. gini’s categorisation engine turns all that text in your statements into actual store names and logos, and categorises them in easy-to-read graphs and charts that paint a full picture of a user’s spending habits.” In the future, through the use of data science, gini has hopes of giving users targeted rewards and offers based on their spending patterns.

Most importantly, however, the app operates using bank-level security. It grants users with read-only access, further protecting their privacy by anonymizing and encrypting sensitive information using 256-bit encryption. On top of that, personally identifiable data and banking credentials are never stored on any kind of server – everything stays on the device. gini is also in the process of becoming compliant with the Payment Card Industry Data Security Standard (PCI DSS). “This certificate will validate our claims of security. So we’re really excited to get that,” adds Victor.

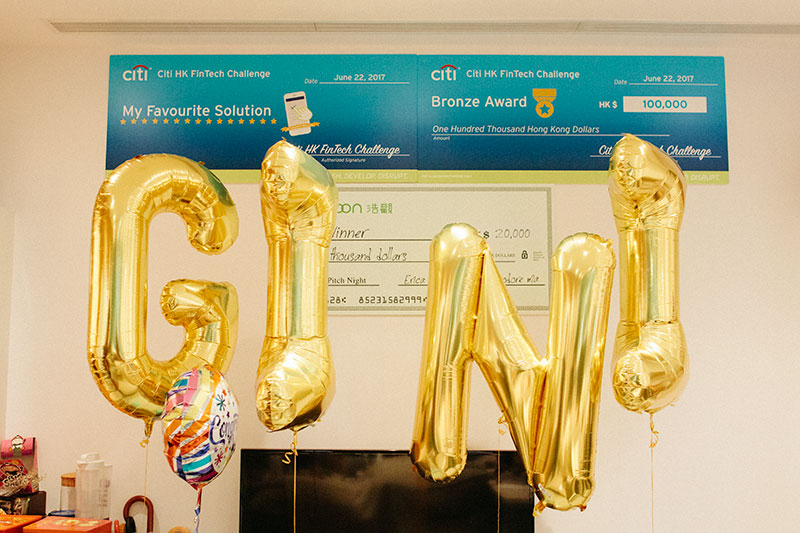

Despite having only launched last month, the banking app has already made waves in the Hong Kong community, jumping to number 9 on Hong Kong’s Apple app store in just 24 hours. “The survey, which we released to the press at our big launch event, created a lot of buzz with the press as it exposed a lot of the fundamental problems that our app is trying to fix,” explains Victor. “That’s essentially why we did so well on the app store.” From its award-winning debut at Citi HK FinTech Challenge in July 2017 to winning the Outstanding Intelligent Financial Management Mobile Application in the etnet FinTech Awards in 2017, this Hong Kong startup has already racked up its fair share of accolades.

Success at these competitions, Victor says, lies in your pitch – “It’s all about storytelling and having a good product. There are so many people out there making apps for things that they can already do. Make something people need.” He also recommends being strategic when choosing which competition you enter. “Always have a reason,” he says. “We only entered competitions that either had prize money or could offer us really good branding. The SuperCharger FinTech Accelerator in 2018 didn’t give us any prize money, but it did give us good branding, as well as the opportunity to forge new relationships and grow our expertise. Don’t enter competitions and accelerators simply for the sake of entering – have a reason.”

Despite their many successes, there have, of course, been challenges along the way, the biggest one being hiring. “In the early days, no one wanted to work for us, because at this point we didn’t even have a name, let alone a website. We just had an idea,” says Victor. “Moreover, one of the biggest mistakes we made in the beginning was that we were too frugal. Had we set the salaries higher, we might have been able to find better people sooner. We’ve learnt from this, however, and are now much more aggressive when it comes to hiring.”

One might think that working alongside family is another one of those challenges, but to Victor, working with family is old hat. “Before gini, I was a founding director and the lead investor at Restore Flow Allografts, a company that derives revenue from human tissue preservation services, in particular, the processing and cryopreservation of peripheral vascular veins and arteries. At the time, my brother Calvin just happened to work at a blood bank, so naturally, he helped me get up to speed on the subject at hand. My mum was also in the medical business, and she actually later helped in advising the company and played a huge part in building up its reputation,” explains Victor. “With gini, we always make sure family comes first. We’ve been through situations where maybe others would leave hating each other or whatever, but we’ve always stuck to the decision that we’d much rather have us, as a family, staying strong.”

In terms of the local FinTech scene, Victor sees a lot of opportunities and also a lot of room for growth, especially within the B2C sector. “A lot of FinTech models here are B2B, so normal people don’t necessarily get to feel its impact on their lives. And that’s the case with so many technologies in Hong Kong. Barely anyone here is using mobile wallets, instead, we’re still all using the Octopus card which is, like, 20 years old now. With an Octopus, I can’t go online and see what I’ve spent, and I can’t send you money using it either – these should both be basic features.”

In the summer, gini plans on launching their full-scale app. “Right now, it’s just the basic functionality, but we’re in the process of building a truly consumer-friendly financial app that integrates within everyone’s lifestyle, helping them achieve their financial goals.” The beta version of the app is currently compatible with Bank of China (Hong Kong), Citibank, Hang Seng Bank, HSBC, and Standard Chartered Hong Kong, and is now available for download via the Apple App Store.

As they say at gini – time is money, so why not save both?

Looking to make your own waves in Hong Kong?

Our professional co-working spaces at the Hive Wan Chai might be right for you. Spanning 5 floors, we offer a thriving community of developers, creatives and entrepreneurs. Just email [email protected] about our FREE Try Out Tuesdays!