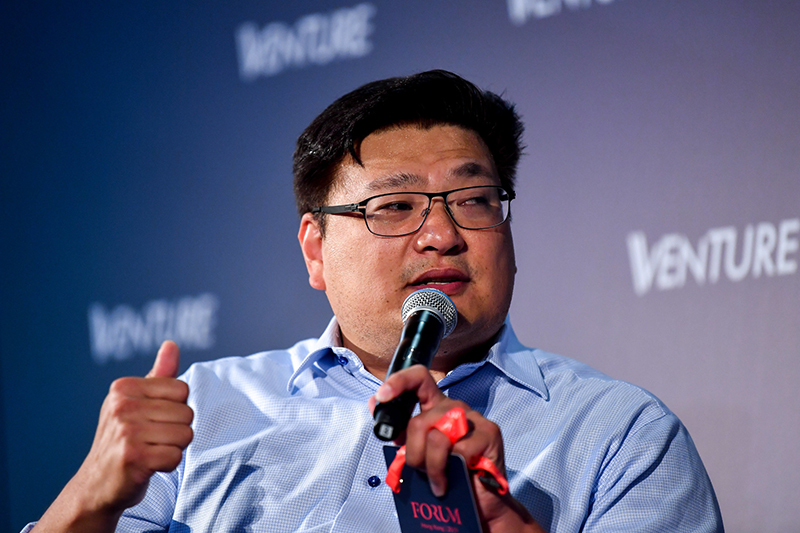

GGV Capital Managing Partner Hans Tung is recognised as one of the top VCs globally with stakes in Airbnb & Slack. At RISE, he talked about spotting unicorns, successful businesses, and the future of the Internet.

A Taiwan native and Stanford Alma Mater, Hans Tung is a five-time Forbes Midas Lister and a Managing Partner at GGV Capital. He was among the first Silicon Valley VCs to move to China full time in 2006, where he bet on the rise of the Chinese consumer Internet market, going on to be an early investor and board member of Xiaomi from 2010-2015. His diverse portfolio today includes three of the top five shopping apps in the App Store – Wish, Poshmark and OfferUp – alongside other starry names such as Slack, Bytedance, Airbnb and musial.ly (now known as Tik Tok). Read on to learn how to spot a unicorn in a sea of startups and who the next billion Internet users will be?

“At GGV, we have about 300 portfolio companies. 15 of them are unicorns. The reason we do that well is that as a firm, we scan globally – and increasingly so in Latin America, Southeast Asia, and India – for solutions to problems created by urbanisation. We then invest locally on the best teams tackling the biggest problems. And, when we look at where the next billion [Internet] users will come from, we think that a lot of it comes from India and Southeast Asia,” Hans explains of his viewpoint. “It is one thing to be in the right place at the right time. It is another thing to figure out whether a lesson from the last battle can teach you about the future that is not always about copying what worked before, but figuring out how it is going to be different.” By analysing local communities and society from a sociological rather than a purely venture capitalist point of view, Hans has stood out, making a fortune by investing in 15 unicorns so far – and counting.

Photo credit: Stephen McCarthy/RISE

“Successful founders tend to be those who have thought about the problem that they want to solve for a long time and who learn extremely quickly,” says Hans of what he’s learned about those that take their companies to the top. “Take Lei Jun, the Co-Founder and CEO of Xiaomi, for example. I met Lei Jun in 2007 when he was leaving Kingsoft. He was actively thinking about the mobile Internet, e-commerce and social networking – and studied every phone that was out in the market. These three elements became the core tenets of Xiaomi and Lei Jun had been thinking about them for three to four years before Xiaomi started. Knowing the industry and customers’ pain points to the extreme is crucial. Another important trait is leadership. Lei Jun got people he wanted to work with him to build something seemingly crazy at the time. He had close to one million fans on Weibo. That gave us confidence in his leadership.”

After being in China for eight years, in 2013, Hans travelled the world, forming the opinion that the next big idea won’t come from Silicon Valley or Shenzhen, but instead originate in places like Jakarta, Bangalore and São Paulo. GGV Capital uses insights from their current holdings in the US and China and they predict that the next billion [Internet] users will be unique and different. How so? “They are young. 47% of them are less than 24 years of age. 70% of them rely on mobile. Culturally, they’re very diverse and speak multiple languages. Most of them don’t have a credit card, or a debit card even, which is why we’ve been actively looking into mobile payment systems.” Hans also implied that younger users tend to gravitate towards newer platforms long before they’re made aware of Snapchat or Twitter, as seen with musical.ly and Bytedance.

You might also like 7 Tips For Business Success in Asia

He believes that by leveraging young users’ tastes and interests along with focusing on localised solutions to local problems, a startup can grow into a unicorn or a dragon in the case of China, declaring to his audience that “the lessons we learned are that speed and skill do matter. The countries that we’re looking at include Indonesia, Vietnam, Brazil, Mexico, and India. They have enough of a home base, or the adjacent market nearby is big enough for them to claim those markets.” A combination of audacity and exceptional data is what GGV Capital looks for in a startup. “When I go to Bangalore or New Delhi, the founders are willing to meet me at midnight, be it Saturday or Sunday. I see the drive they have when I go to these offices. You smell the sweat of people working and you’re energised about what they’re building. It is extremely inspirational to see them believe in something bigger than themselves.”

Through his experiences with 15 unicorns, Hans has seen multiple patterns of success that he now uses to guide founders in the right direction. “I always like to joke that I don’t need to be the smartest guy in the room. I just need to have a lot of good data. Our biggest value-add is being the coach or adviser to the founders to help them work through challenging issues using patterns we have seen from our past successes. We have insights and resources in specific sectors to share with founders. For example, in the micro-mobility sector, we have invested in Hello in China, Grab in Southeast Asia, Lime in the US, and Grin plus Yellow, called Grow, in Latin America. Through our network and expertise, we helped Didi become an investor in Grab so Didi could help Grab set up new centres in Beijing.”

His advice to anyone looking for VC funding is, “I was a founder twice and received funding twice, so I understand dealing with the board can be hard. I think the founders need to think about what they want to achieve in their lives before they start the company. Not everyone needs VC money. For those who want to scale and do take VC funding, then you have to contemplate the impact that you can make to the VC fund. If a company is not scalable and can’t have a big outcome, the fund is less likely to roll out its resources to help. As for us, the opportunity cost of resources can be very high.”

Hans encourages people looking to start their own company to get as much experience as they can. To this end, GGV Capital has a program called ‘Founders and Leaders’ that recruits people from companies like Facebook and Airbnb to teach them how to scale their own startups the right way. He thinks the very best way to learn is on the job with other companies that are growing fast and have raised three or four rounds of VC funding. “You need to go through the cycle and get a firsthand glimpse of what it takes to scale a business to get ready for your own startup. Then, once you do start, you’re better positioned to deal with obstacles along the way. Be very careful about what you engage yourself in because once you start doing it, you may get stuck for the next five to ten years. When you have 50 or 100 employees coming to work because of you, the pressure is very high. There is an immense sense of responsibility. So, choose very carefully and be ready, is the advice I give to potential founders.”

Related Articles

Uber @ RISE: How They See Their Future, and What They’re Planning Next

Breaking Down Biohacking: Silicon Valley’s Hottest New Health Craze