Legaltech disruptor SeedLegals has entered the Asia market to help startups in the region start, raise and grow. SeedLegals’ Head of Asia-Pacific, Hsiang Low, speaks with Hive Life about their support for early-stage startups, the evolution of the legaltech space, and the potential of the startup ecosystem in Asia.

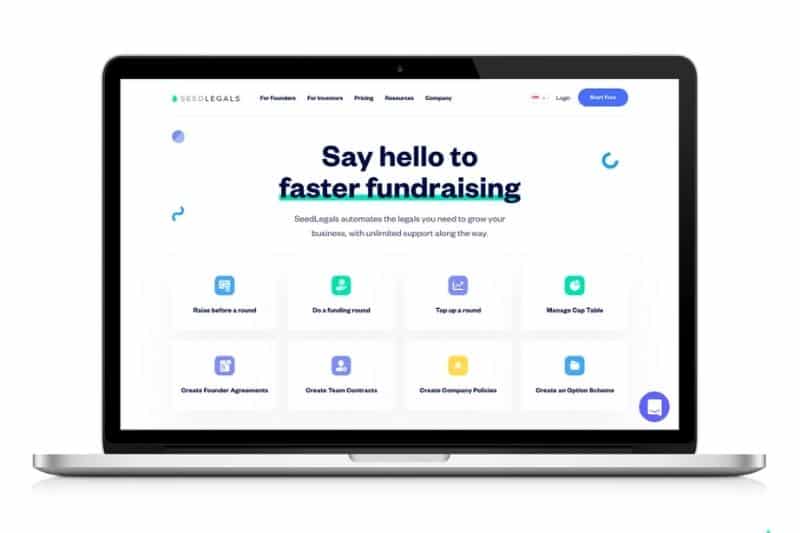

SeedLegals was established in 2016 in the United Kingdom as a means to streamline and automate the legals startups need through its one-stop platform. Serial entrepreneur Anthony Rose and serial investor Laurent Laffy built a seamless, accessible, and targeted legal solution for the UK’s nascent startup network. Eventually expanding its reach across Europe, the legaltech provider began its expansion to Asia-Pacific in 2021 with the launch of its services in Hong Kong and Singapore.

The platform has attracted many early-stage startups looking to shift away from the traditional and complex legal processes of starting out and fundraising. SeedLegals provides an automated solution, empowering new founders and entrepreneurs to digitally establish, manage, and grow their ideas, while providing support as they secure investments.

Lawyer, tech-enthusiast, and now the Head of Asia-Pacific for SeedLegals, Hsiang Low, is working to simplify legal procedures for startups in the region by offering tech-enabled solutions through SeedLegals. In a one-on-one with Hive Life, Hsiang dove into the potential of legaltech, the scope and functionality of SeedLegals’ platform, and shared his insights on the startup ecosystem in APAC.

Can you introduce us to SeedLegals’ concept?

SeedLegals is a legaltech platform that automates the legals early-stage startups need. Our co-founders Anthony and Laurent kept facing the same problem: every time they tried to get a startup going, they had to pay lawyers for the legals they required- term sheets, documents, resolutions and so on. It was a major hindrance, time consuming and rather costly, so they saw the opportunity to disrupt and simplify this process. Anthony and Laurent collaborated to find a solution using technology and automation.

In the UK now, around one out of six early-stage startup rounds gets processed through SeedLegals, and SeedLegals has been used by over 35,000 startups and investors. We have seen a phenomenal demand for the service, and have helped startups at their earliest stages of growth at a more efficient and affordable price-point through our unlimited support system.

Can you tell us more about your role at SeedLegals?

I’m here to lead market strategy, build a team, and steer the business in Asia-Pacific. I work with local private and government ecosystem partners, coordinate and develop a cohesive market strategy, study and make regular improvements to ensure our products are suitable for the local markets, and find creative ways to support our startup network.

What were you doing prior to joining the SeedLegals team?

I started my career as a private practice lawyer at a Magic Circle law firm called Linklaters, specialising in capital markets and structured finance. During my time there, I got exposed to many international deals, while also getting my professional training, developing technical legal and soft skills. This exposure enabled me to develop a greater sense of diligence and strategic thinking.

I later had the opportunity to help my law firm with a strategic project to create an in-house legaltech startup. During the launch of this startup, I moved to Hong Kong to run the Asian side of the business, where I introduced and rolled out the product and solutions across Asia. It was personally very rewarding to help clients understand how the use of legaltech could benefit their work, and to ultimately see how the technology we were building was changing the way clients did business.

How has Asia presented itself as a viable market for your platform?

Asia is blooming in terms of startup activity, and has set itself apart from Western Europe and North America for a number of reasons. One is its growing middle class and educated population, as well as increased internet and mobile usage across Asia.

The Hong Kong and Singapore governments have done plenty to promote and support the growth of startup activity. We work closely with both private sector and government ecosystem enablers to find more ways that SeedLegals can help foster the growth of startups in this region.

The common law systems that the UK shares with Hong Kong and Singapore made the legal documentation that we were transporting across more familiar, making localisation an easier process, as well as usage of the English language.

Singapore and Hong Kong are financial hubs, where investors come into Asia, due to the level of certainty in law, and familiarity with the legal system and it made sense for us to be where investors go.

What motivated SeedLegals to enter the Asian market?

Around late 2020, I was introduced to Laurent in a casual conversation. Laurent told me about SeedLegals and I was amazed by it and wondered why they had not expanded beyond Europe. After numerous discussions we concluded that this was a great moment to enter the market off the back of the high growth of new startups in this region. We took the plunge, I joined the company, hired a local team and now here we are!

What makes SeedLegals an ideal platform for startups in Asia?

A number of things- you get educated, the right training, the required content, and our guidance along the way, with our team that helps you get started.

The data that we obtain, we utilise to educate and inform our clients, while improving our products. Our services are streamlined and tailored to support a startup’s journey. Startups benefit from the efficiency and affordability that comes with the automation that we provide.

What impact are you hoping to make?

We hope to become a household name for any startup in Asia. There is a large gap in the market for services like ours in the region. Right now, startups are underserved, and do not necessarily have the support that they want or need.

The choice right now for most startups is to either go to an expensive law firm or google a free template, and unless one knows what they are doing, it can be quite dangerous, in regards to how one customises those documents.

This is where SeedLegals can help. We have a strong focus on startups, so our services and support is catered specifically for this category. Anyone coming to us would have the benefit of our experience helping many founders over the years.

How does SeedLegals help facilitate a startup’s initial stage success?

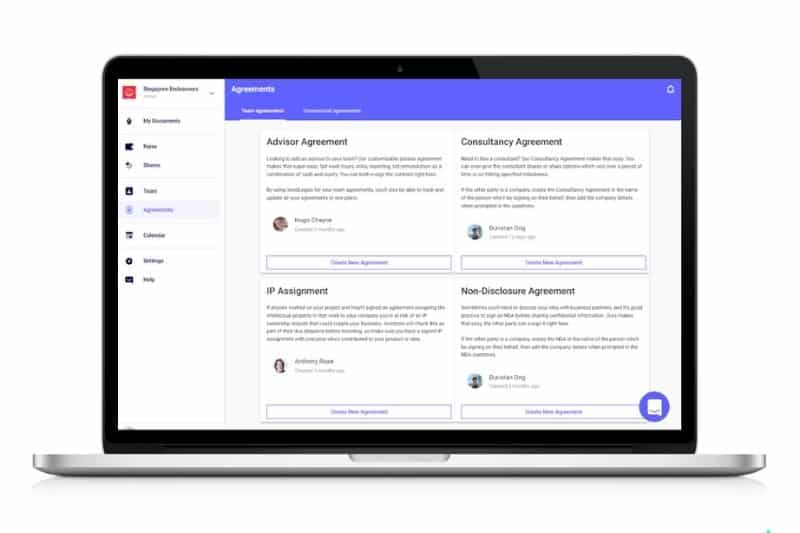

The platform is all digital, so our founders can easily join and access everything they need.

Our live chat function also offers unlimited support to all our customers at no extra cost. We recognise that in the early stages of your growth, you need human support and guidance to help you grow.

How does SeedLegals differ from traditional legal service providers?

We are primarily startup-focused-everything on the platform is focused at the early-stage company and new founders. The assumption we make is that if companies come to us, they are probably not from a legal background- our philosophy and strategy is to educate and empower startups.

We provide free educational materials, articles, webinars, seminars, and events, everything aimed towards educating and empowering founders and their teams. We are not so focused on solely producing necessary documents, but preparing and educating founders.

What are some of your more highly-requested services?

Startups come to us to help them with the legals around fundraising, and to help them set up share option schemes.

In the current market, we’re seeing a lot of interest in our agile fundraising services, which enable founders to take small investments instead of only focusing on large funding rounds. Since companies take smaller sums to raise capital, the process is quicker and faster to close. It also ties with the current environment where the economy is a bit shaky with interest rates rising, and valuations are depressing. So, if you want to extend that runway by taking smaller cheque sizes, we have tools to help you do that.

Later, when startups are ready for their primary funding round, we speak with our founders and help them get investment ready by creating a term sheet, which lays out the terms of investment. What we try to do here is put the founders in a closer playing field to the investor by educating them, and ultimately, empowering them to make better deals.

With our share option schemes, startups can create complex share option agreements, allowing them to reward and incentivise their employees, attract top talent and future proof their business.

Can you share some more about how SeedLegals fits in with the market?

We have an ecosystem strategy here, and partner with a wide variety of players – everything from accelerators, to government bodies, to investors and coworking spaces – basically everybody who is part of the startup ecosystem.

Later this year, we will be working with a VC advisory body that empowers female entrepreneurs, it is something we have been quite passionate about and are looking to make an impact on that segment of entrepreneurialism. We are partnering with them by utilising our data to support female founders on their journey, fundraising, and more.

We are also working with accelerators and exploring ways that we can support their cohorts. As they come in, we offer them our services, educate them along the way, and get them investment ready.

What can we look forward to seeing from SeedLegals as you continue to expand your reach across Asia?

We will continue to make strides with the products that we have, and invest in what the market is demanding, as our customers here may require slightly different products and services to those in Europe.

We just launched our Share Option Scheme solution in Singapore and Hong Kong and are going through the discovery process to produce more products that are tailored for the regional market. There is plenty in the pipeline for us.

We are also looking to expand and invest in growing our team locally to continue providing localised services in Asia, so our clients will be coming to locals who understand the market demand, and most importantly, are within your time zone.

In the near future, we are also excited to explore the possibilities in the startup space, from the advent of new technologies, to increasing use of web 3.0 and blockchain technologies.

Do you have a legal tip to share with startups in their seed stage?

The main thing is to get your house in order and be investor-ready before you approach your investors for fundraising. And “getting your house in order” is rather broad, such as having your founders agreements ready, whether you have completed your IP assignment, and properly documented your employment arrangements.

Knowing upfront what you are willing to “give away” in return for investments is key. Similar to any other negotiation, you want to be armed, and that is where we help with everything, to get you ready and supported for that.

Interested startups can reach out to the SeedLegals team at seedlegals.com.

Related Articles

How to Accelerate Funding for Your Startup