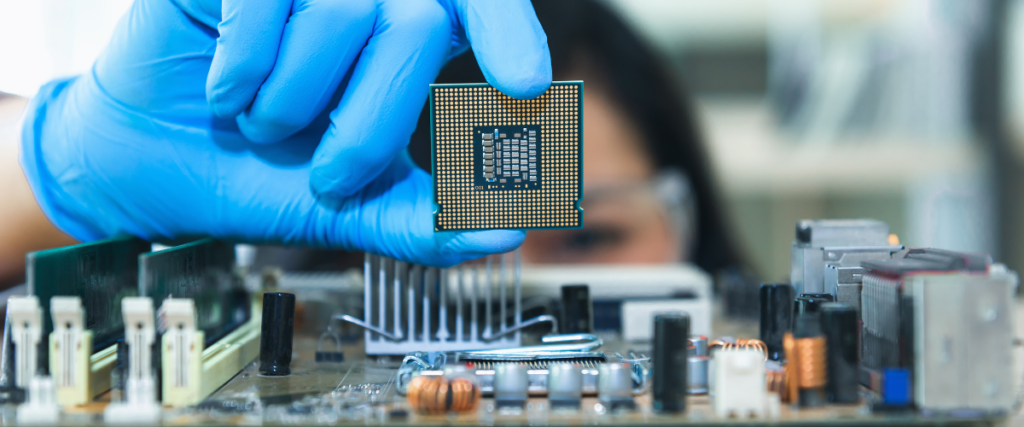

American firms aim to cut reliance on Taiwanese and Chinese chip manufacturers.

Tech suppliers in Taiwan, Japan, and South Korea have now joined China on the list of “dangerous risks” to U.S. national security, highlighting Washington’s desire to strengthen its own supply chains and cut reliance on Asian chip manufacturers.

“It’s going to be a challenging and long journey for them to diversify away, and thinking about how long it takes for the chip development and cooperation — it’s going to take a while,” says Sebastian Hou of CLSA.

In a report released on June 8, U.S. officials provided a comprehensive account of weaknesses in the United States’ supply chain, with reference to four key areas: semiconductors, high-capacity lithium batteries, pharmaceuticals, and rare earth minerals.

The aforementioned countries have established leading positions in high-end chip manufacturing capacity, producing more than 70% of global semiconductors. As of Mid-April this year, U.S. tech firms such as Apple, Google, Qualcomm, NVIDIA, and AMD rely on Taiwanese chip manufacturers to produce up to 90% of their chips. And in 2019, China was responsible for approximately 80% of rare earth imports to the U.S., according to the U.S. Geological Survey.

Japan provides 90% of photoresist worldwide, a light-sensitive material involved in chipmaking. As for South Korea, companies such as Samsung and SK Hynix make the country the global leader in memory chips.

While much of the report is aimed at China, the main competitor against the U.S. for dominance in technology, it also discusses the White House’s worries regarding reliance on suppliers in Taiwan. While friendly on political grounds, the territory is designated as a liability to the United States, due to its sensitive geopolitical relationship with China. U.S. reliance on these two economies puts American and global supply chains at risk, the report says. Rare earth magnets are used in electronics by both civilians and the military, and according to a Reuters report in December of 2020, the Department of Defense is developing a program that aims to boost semiconductor manufacturing capabilities for military purposes.

Last December, Washington blacklisted China’s Semiconductor Manufacturing International Corporation (SMIC), restricting American companies from conducting business with the firm.

The report also suggests that the U.S. will see more government involvement in tech manufacturing, and that a “whole-of-country” effort will be necessary to bolster the manufacturing process and build a self-sufficient supply chain. A bipartisan bill allocating over US$52 billion to American chip manufacturing and research was passed on the same day that the report was published.

Related Articles

US Sanctions Will Hurt Chip Development, Says SMIC

US Tech Sanctions on SMIC will Affect Huawei, Apple, Samsung