Do you have a new business idea and are ready to seek funding? Expand your investment opportunities with the top venture capital firms in Singapore.

One of the ways to get your company off the ground is to secure funding from a venture capital (VC) firm, particularly those that specialise in growing startups and mentorship. Hive Life has compiled a list of the top venture capital firms in Singapore for those seeking investment for your company.

Jungle Ventures

Jungle Ventures is a VC firm that prides itself on collaborating with founders directly and providing long-term, scalable solutions and capital to institute growth. In addition, Jungle Ventures takes funding one step further by providing collaboration, advice and mentorship to entrepreneurs, which is possible because of their own background in founding companies.

They believe that founders make the best CEOs and to build companies that last, one must invest in a leader as much as the company itself. Jungle Ventures has grown to be one of the largest independent venture capital firms in Southeast Asia, with over 35 investments made and US$600 million assets under management. Their combined portfolio value is upwards of US$12.5 billion and growing.

Their portfolio is diverse and expertly curated, not taking on too many projects at a time, to ensure maximum success of each business. They do not believe in investing in only one kind of venture, rather independent thinkers with great ideas.

Life.SREDA VC

Life.SREDA is an international venture capital firm headquartered in Singapore that specializes in FinTech exclusively, being one of the first non-corporate VC funds to do so. So far, they have invested in over 20 FinTech companies across the globe via their two separate funds – Life.SREDA I, worth US$40 million, and Life.SREDA II Asia, worth US$100 million.

In addition, Life.SREDA runs a separate blockchain-focused VC fund, Blockchain Fund (BB Fund), with an impressive roster of founders, namely Chris Skinner, leading FinTech and blockchain expert, and Thomas Labenbacher, a serial FinTech entrepreneur and angel investor.

Crystal Horse Investments

Crystal Horse Investments is a VC fund that seeks out technology companies in their early stages to help scale regionally and globally. Their investments take place during the angel or seed stages of companies, meaning startups are well-represented in their portfolio.

The VC firm is based in Singapore and Malaysia, with its main focus being in the South East Asia region, and collaborates with larger firms in the greater region. Their investments mainly focus on the internet, mobile, and data service industries, particularly with companies that leverage tech to scale. The firm is pro-founder and entrepreneurship, and highlights guidance and support from their internal team.

Innosight

Innosight is a VC firm that focuses on disruptive change and innovation, preparing company leaders to navigate whichever ever-changing industry they inhabit. They look at the world differently, as leading experts on disruptive innovation, the constantly changing business landscape, and emerging technologies.

Innosight works with companies to foresee tomorrow’s customers point-of-view, which trade offs they will be willing to make with new versus traditional marketing strategies. The approach is “future back,” meaning Innosight prides itself on looking forward, opposed to being reactive. Ultimately, Innosight is a growth strategy consulting firm, working in a range of industries, from healthcare to energy and resources.

Dream Labs

Dream Labs focuses on “investing in the improvement of mankind.” What this means more specifically is that this Singaporean venture capital firm invests in companies, leaders, and even ideas that have the potential to positively impact lives.

Namely, they invest in FinTech, CleanTech, e-commerce, healthcare, and energy, with a people-first approach. Dream Labs is a US$50 million fund that works with entrepreneurs who seek to invent entirely new market categories and disrupt and transform existing ones, with an almost exclusive focus on potentially scalable ideas. They aim to create not only significant financial returns, but also affect social change.

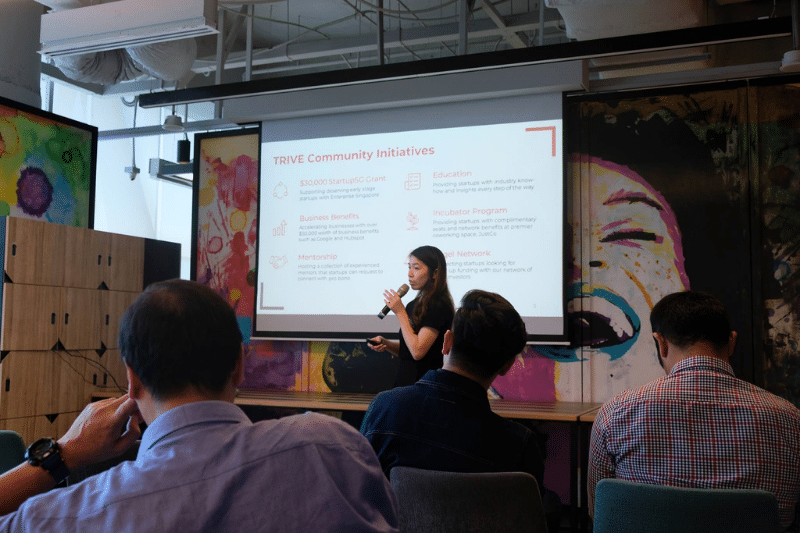

TRIVE

TRIVE is a venture capital firm founded in 2015 that specialises in backing founders that tackle the largest gaps – namely, accelerating sustainable economic activities in Southeast Asia via the Positive Impact Technology Fund I, a 10 year project.

They often work with companies in the seed stage to provide scalable growth in a sustainable capacity, investing between US$400 thousand to US$800 thousand at this stage. Their portfolio is kept small – around 25 investments – to ensure that each company receives the focus it needs to thrive. Their primary sectors for investment include manufacturing, healthcare, education, and agriculture.

Purpose Venture Capital

Purpose Venture Capital is an early stage VC firm that builds sustainable and profitable tech businesses. Their aim is to support entrepreneurs in the tech industry who have an ultimate goal of creating a positive impact on the world.

Their portfolio currently includes a digital pet health service, and innovative service solutions tech companies. In addition, they have recently partnered with Asia’s largest global sustainability challenge for 2022, organised by Eco-Business and the Temasek Foundation, the Liveability Challenge, demonstrating their commitment to positive social and environmental change.

Featured banner image credit: @TRIVE.VC

Related Articles

How to Register Your Business in Singapore

How to Craft a Winning Startup Pitch to Attract Investors

8 Sustainability Startups in Singapore to Watch