Demand for food is only growing bigger while food supply resources are increasingly constrained. This critical problem is here to stay, and AgriTech is here to solve it. Keep reading to learn more.

By 2030, the global population will rise to 8.5 billion and Asia’s alone will reach 4.9 billion. Out of this, 2.3 billion new middle-class consumers are predicted to emerge, and 90% of them, with their higher purchasing power, will be in APAC. As cities continue to grow, more than 60% of the urban increase will happen in Asia. Urbanisation not only changes food consumption patterns, it reduces agricultural land and farm labour. There is also the global water shortage and climate change to further challenge our food production. How will we generate enough available, affordable, and safe food for everyone?

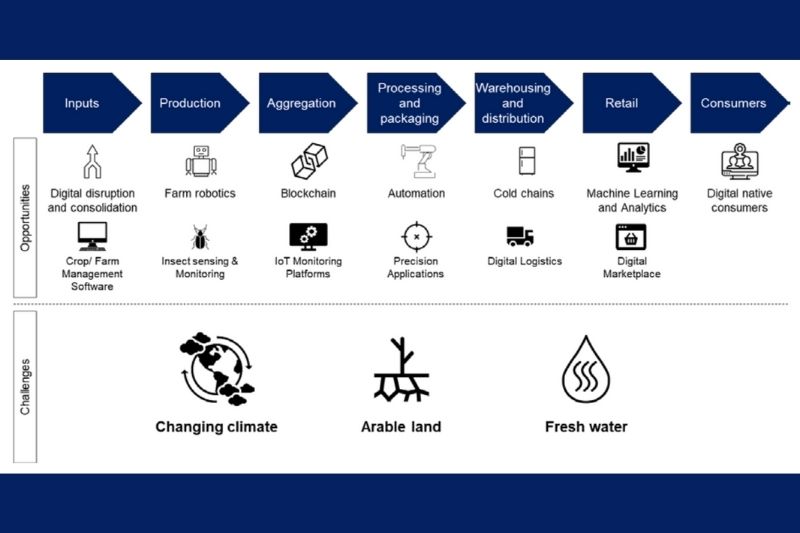

As the statistics show, APAC is the consumption magnet and demand driver, and will be most troubled by the gap between soaring demand and limited supply. APAC must also, therefore, become the biggest opportunist during this crisis. Enter AgriTech: using innovative technology to bridge our food gap, its rise has been unstoppable. We’ve put together a quick map to help you understand the lay of the land.

Map of AgriTech

AgriTech’s offerings lie on various parts on the farming value chain:

Inputs

“Inputs” refers to the resources a farmer has to supply, for example, fertilizers, pesticides, soil amendments, genetically modified seeds, pest control, or animal feed. Agronomy and agricultural biotechnology are the keywords to check out when looking for innovative inputs created by scientific tools and techniques.

Labour and money are also resources that need to be put in. A big struggle for some farmers is acquiring necessary equipment and funding, especially in Asia as farms tend to be smaller in size. AgriTech companies are exploring offerings like farming-as-a-service (FaaS), agri-equipment rentals, and FinTech funding solutions like digitizing payment and loan administration, or apps that allow lenders to check farmers’ credit.

Production

“Precision agriculture” is our century’s transformation of traditional agriculture. Think Internet of Things (IoT) and automation. Drones, sensors, and image recognition tech can collect data through monitoring crop and equipment conditions, analyse that data to predict the weather or optimise resource use, and then make the correct intervention in the actual crop field. The results: reduced labour costs and boosted crop yield.

“Novel Farming Systems” is the name for entirely new, non-traditional farming approaches. With hydroponic, aquaponic and aeroponic techniques, soil is no longer required to grow produce, meaning we can farm in spaces like urban rooftops, controlled indoor environments, and vertical growing towers. The global vertical farming market size is expected to grow sixfold from USD $2.23B in 2018 to $12.77B by 2026, while the aquaculture market size will reach $274.8B by 2025. Why the hype? These systems allow farmers an extra degree of precision with the nutrients that go into their produce, making them more flavourful and more nutritious. They use less water and energy than traditional farming. And food can be locally grown in cities, where neighbourhoods can be converted into “agrihoods”, which gets rid of import-based disadvantages like carbon emission, delivery times, and food wastage. Also keep an eye on adjacent spaces, such as genetic modification technology that adapts vegetable varieties to indoor farming needs.

Aggregation, Processing & Packaging, Warehousing & Distribution

Roughly a third of food produced globally is wasted as it makes its way through the supply chain, and Asia is responsible for over half of it. This $1.2 trillion USD cost to the global economy has become a market opportunity for AgriTech companies solving supply chain inefficiencies.

One approach is to preserve food for longer through tackling packaging and infrastructure. Technoserve and Meru Greens’ project, for instance, offers smallholder farms access to commercial-scale, solar-powered, “pay-as-you-store” refrigeration units. Another approach is to recycle food waste. The company Zembra Group uses creative biorefining technology to convert by-products from olive oil extraction into a whole spectrum of products. A third approach aims to prevent food overproduction in the first place, by using data analytics to track supply and demand. Startups in this space make data-driven insights, such as consumer demand, available to farmers so they can plan production accordingly.

Transparency in the supply chain is another aspect getting transformed. Blockchain technology allows transactions to be recorded instantly, with confirmation from all parties, and with everyone being able to access this information. Essentially, it creates a tamper-proof record, “a single and shared version of the truth.” Startups are using Blockchain to let consumers trace a food product’s journey from farm to shelf, feeding into the Millenial and Gen Z megatrend of factoring sustainability and social impact into their purchasing decisions. Aside from consumers, this supply chain transparency also helps farmers: they see where, for what price, and how much of their products are sold, so they can better set their own prices instead of having them dictated by middleman traders.

Retail and Consumers

What about solving supply chain problems by shortening the chain itself? During the Covid-19 pandemic, some farmers had to dump tonnes of produce because lockdown reduced transportation capacities, and they did not have direct access to consumers. One variety of AgriTech company connects different stakeholders to each other. Marketplace platforms aggregate the produce of small scale farmers and connect them with consumer markets like retail chains or FMCG giants. By cutting out the middleman, better prices can be offered to farmers and retailers. There are also startups focusing on making hard-to-find data available to farmers, to help them make more profitable crop choices. Other apps enable food sharing between consumers. This would fit with the global, post-digital, post-Covid trend of shorter supply chains in many industries. It would also mean shrinking profit margins for intermediaries like distributors and traders.

Alternative food sources

Developing markets, notably China’s, are catching up their protein-consumption levels to those in first world countries. However, consumer attitudes towards meat farming are shifting, as awareness of its moral and climate costs grows. On top of that, the worsening obesity problem is becoming a global priority. All of these emerging trends point to the rise of alternative protein sources.

AgriTech startups focused on developing alternative protein sources can be categorised as follows: those cultivating cell-based meat (which we can no longer write off as a pipe dream), those processing and expanding our repertoire of protein-rich plants (like soy, pulses, cereals, tubers, microalgae, and even duckweed), and those exploring insect-farming.

Now that we’ve mapped out the basics to understanding AgriTech, we’re ready for an in-depth look at individual APAC countries – their specific agricultural situation, future challenges and noteworthy startups. Keep your eye out for the rest of this series.

Related Articles

OzHarvest: This Female CEO is Leading the Global Revolution Against Food Waste

This Melbourne Food Rescue App is Tackling Australia’s AUD 20 Billion Problem