Kristal.AI is an AI-powered digital asset management company that wants to give smaller investors a leg up. Hive Life spoke to the co-founders about why investing is essential, and what all beginners should know.

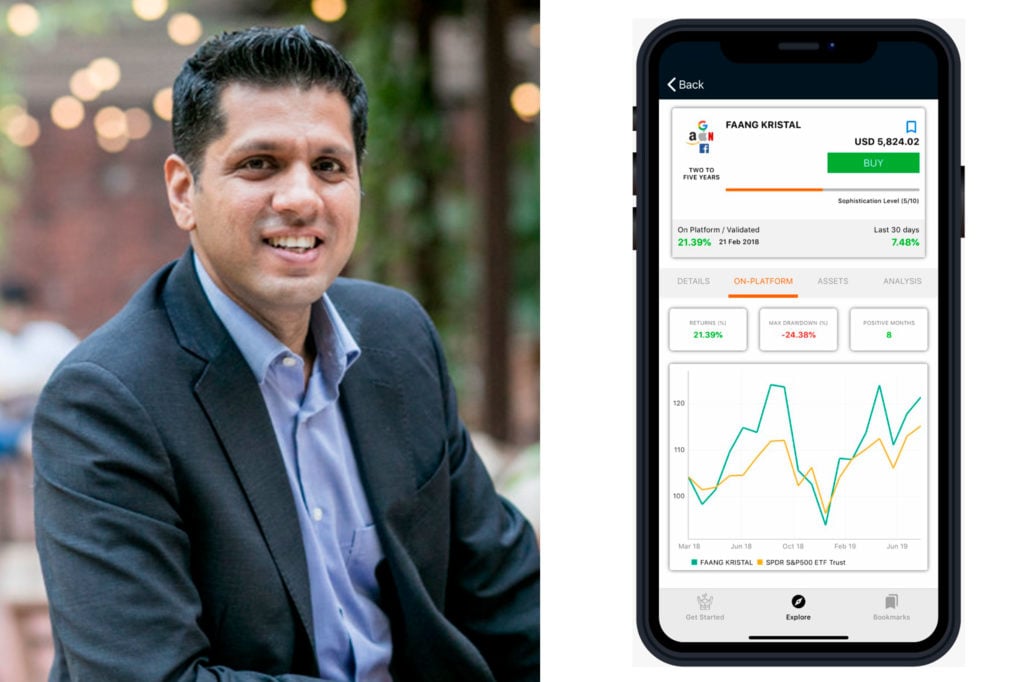

We all know that saving money for the future by investing is just good sense, but getting started can be a daunting prospect. This is what the entrepreneurs behind Hong Kong and Singapore-based platform Kristal.AI, created to make investing more accessible, are trying to solve. Co-founders Asheesh Chandra, who has had over 15 years of experience in the financial industry, and Vivek Mohindra, ex-Director at Merrill Lynch, have created a digital wealth manager that uses artificial intelligence to even the playing field, giving smaller players access to investments that they otherwise couldn’t get through traditional banks.

“We are in the business of giving access to certain investment solutions or advisory services and products to the masses,” says Asheesh. “Typically, these products are denied to them. Most people are sent away by traditional players because they don’t have millions.” For the pair behind Kristal.AI, giving more people a chance to get in on the investing game is a calling they feel strongly about. “I think we owe it to the younger generation, or people who are not as well-to-do, who don’t have big savings or know how to invest, to help them do that. That’s the best way of achieving financial inclusion, rather than just making the rich get richer and the poor get poorer, because that’s what is happening in the world today. This is our way of enabling everyone so that they can invest in their futures.”

Here are the five guidelines they recommend to help you build an investment portfolio from scratch.

#1

Taking irrational risks can negatively impact your mentality toward investing – so don’t!

Doing your research and making strategic choices is the best way to get comfortable in a space you’re unfamiliar with, so avoid taking huge risks based on hot-topic trends that might not work out in your favour. “One pitfall you should avoid is just going into a half-hearted, half-researched investment. In your first few investments, you’re most likely going off of a friend’s recommendation on a particular trade or stock. And when you burn money on that stock, because it will happen eventually, since it was not well thought through, the setback is your mentality. It will then take you longer to get back into investing.” Instead, seek out investments that are calculated and well-thought-out.

#2

Take bigger risks when you’re young

The time to take bigger risks is when you’re young. “It’s basically investing in yourself for the future. In terms of constructing your portfolio, if you’re a young investor, you can go and take risk off an equity portfolio rather than putting it in a safe, fixed deposit. You have a whole career in front of you. You will be earning more and more in the years to come. So, you don’t have to be very conservative, leaving money in a bank and doing nothing with it when you could be earning and educating yourself on how to make money with what you have.”

You might also like 8 FinTech Apps To Streamline Your Personal Finances

#3

Make a game-plan and stick to it

A common pitfall for first-time investors is treating them like a gamble when they don’t have to be. “The general rule of thumb is that you should be investing a portion of your savings based on your age. So, if you’re 20 years old, 80% of your portfolio can be in risky investments, and 20% can be in lower-risk investments. If you’re 30, 70% can be allocated to risky investments, and 30% to lower-risk investments. It’s about strategic uses of your earnings that will take time to show results,” says Asheesh.

#4

Diversify your portfolio the smart way

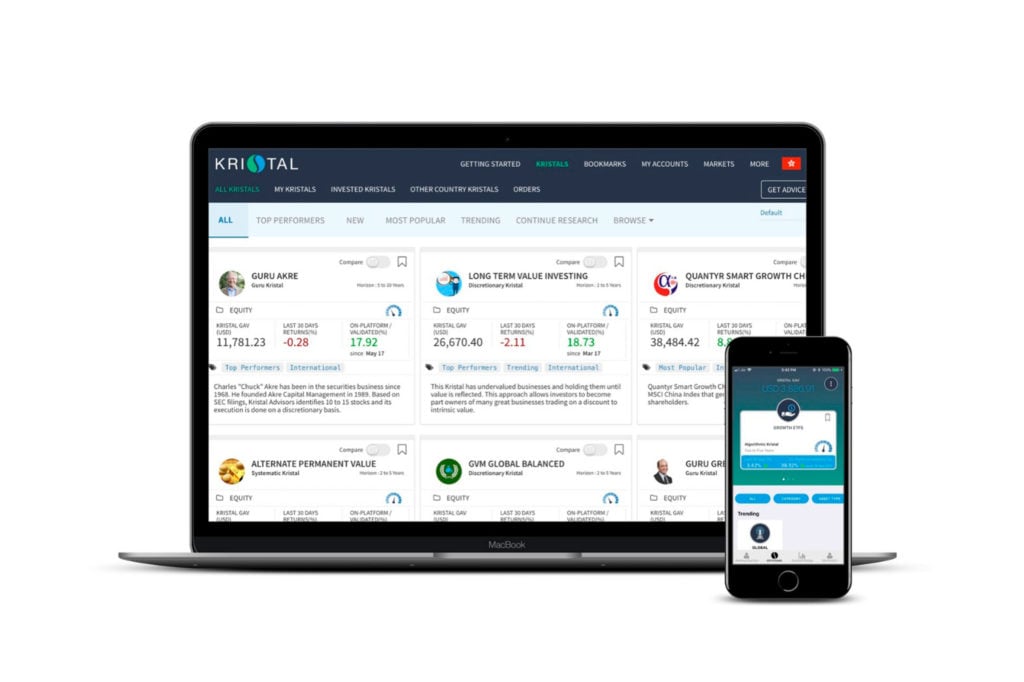

When it comes to knowing what you should put your money into, the flood of data out there can be daunting. “I didn’t have access to anyone who could guide me, because you don’t get any guidance unless you have high net-worth. That’s the problem that we’re addressing,” says Asheesh. “There are two ways to diversify your investments. One is when people choose a portfolio themselves, or you can use the algorithm on Kristal.AI which does an asset allocation. Based on your profile, age and income level, the algorithm can customise a carefully curated portfolio of investments for you, and suggest what ratio in which you should invest. Then it constantly oversees that portfolio. The portfolio will move as markets move, but if the markets do have a sharp correction, then Kristal.AI will suggest a change that you can choose to follow or not.”

#5

Start investing as soon as possible

According to these entrepreneurs, money left sitting in a bank is a wasted opportunity, so they encourage that you invest any amount you can afford. “Within the first couple of months of a payout, a small portion should go into an investment,” explains Asheesh. “When this generation gets to their 50s and 60s, it’s going to be too late to realise that, had they put USD 1000 into a stable growth investment 40 years ago, it could have turned into a couple million. They’ll be close to retirement without a plan. So, it’s much more relevant for today’s generation because the concept of a salary is kind of evaporating. That mindset takes some time to develop, but that’s what needs to change – the idea that learning about investments is uncool or boring. We hope to make it interesting.”

Related Articles

15 Things You Should Know About Crypto

The New Savvy Empowers 100M Women To Gain Financial Independence