Looking to simplify how you manage your finances, start saving smarter, build an investment portfolio or streamline the way you organise your bills? Here are 8 Fintech apps just for you.

#1

8Securities

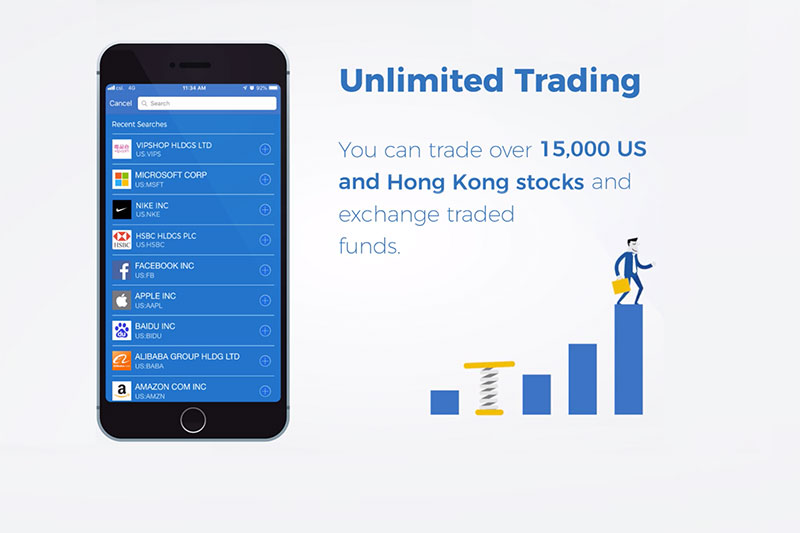

8Securities is an app that allows users to invest and trade Hong Kong and US stocks and ETFs (Exchange-Traded Funds) – all with zero commission. Based in Hong Kong, with tens of thousands of users from 50+ countries around the globe, it’s already immensely popular among newcomers to the brokerage scene, who like it for its very own trading school where they can learn from expert investors and community where trade ideas are exchanged.

#2

Prism

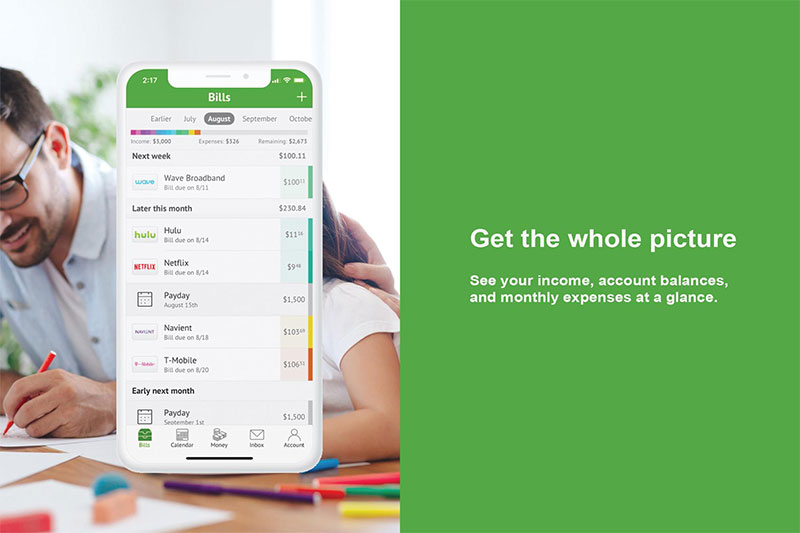

When you’ve got a lot going on, keeping on top of all your various bills can be time-consuming – and it’s easy to drop some balls. Prism is a bill management service that centralises all your bill-related functions in one place. As of 2019, it has been used to pay over USD 1 billion in bills ranging from utilities to rents and mortgages, subscriptions, insurance and more. Made to help everyday people keep track of all their bills on one app, it has 11,000 users so far and counting. Currently, it is only available for use in the US.

#3

Wealthsimple

Wealthsimple is an investment management service that builds smart investment portfolios for its users – something they bill as “investing on autopilot.” Founded in Toronto in 2014, it’s now expanded to the US and has over USD 3 billion in assets under management. Designed to help its users reach financial goals such as saving for a property, paying off debts or investing for retirement, it assesses your financial situation based on a few simple questions, then uses the money you put in to purchase a mix of ETFs (Exchange-Traded Funds) optimised for you. If you’re looking to invest, but don’t have the time or understanding to decide what to invest in, this app is looking to help. To use it, you currently need to reside either in Canada, the US or the UK.

#4

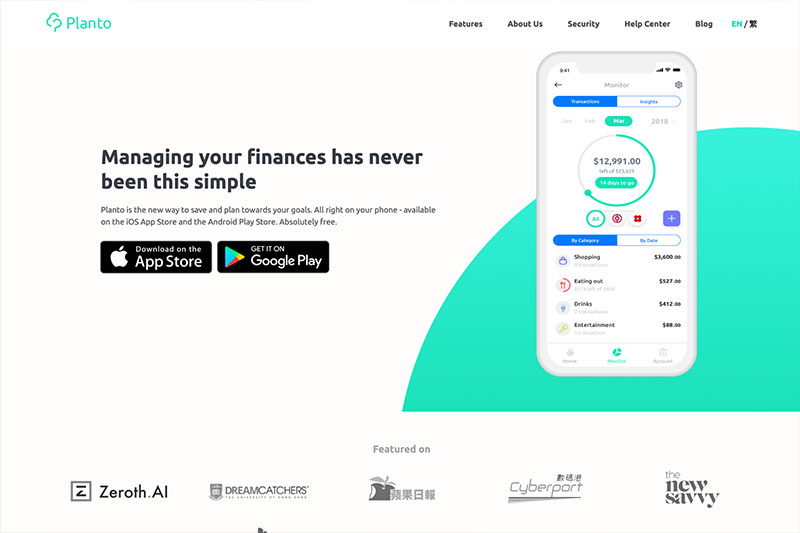

Planto

Planto is a personal finance management app that helps with expense tracking, setting financial goals (i.e. “I want to save $2,000 for my upcoming holiday”), budgeting and more. Based in Hong Kong, this app has become increasingly popular among millennials looking to stay on top of their financial goals and current expenses.

With Planto, users are able to aggregate all the numbers from their financial accounts (bank accounts, credit cards – wherever they spend and receive money) in one place. The app then provides simple and actionable advice to users, as well as giving insights on their financial behaviour. If you’re looking for an app to help you save and reach your financial goals in a simple way, Planto wants to try and get you there.

#5

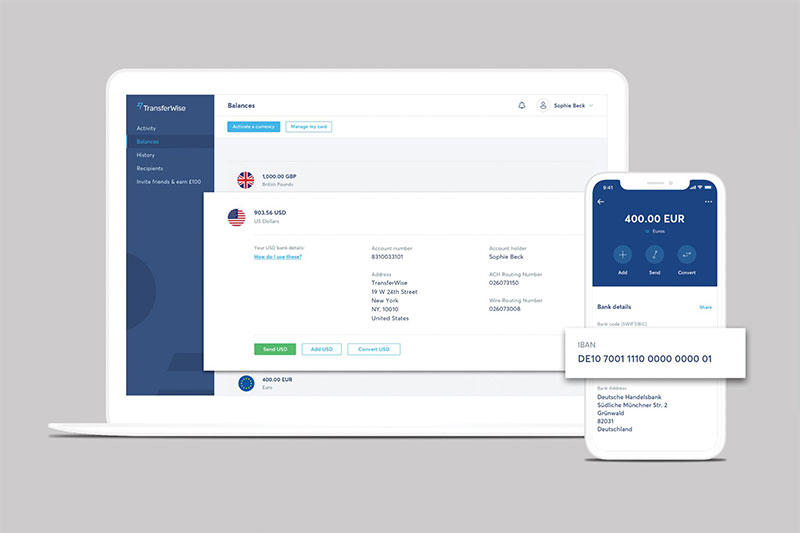

TransferWise

TransferWise allows you to send payments around the world in a way that’s cheaper and faster than your average bank transfer, avoiding the hefty fees and long wait times associated with traditional international transfers as you go. As of today, they have over 3 million customers spread across 69 countries, processing over USD 2.6 billion in transfers every month.

In addition to everything being done online, at every step of one of TransferWise’s transactions, users can know where their money is – via notification emails sent at every stage – until the cash has reached the recipient.

#6

Credit Karma

Credit Karma is a user-friendly financial management app that monitors your credit score and creates recommendations based on your financial patterns. Started in 2007, it now has a large customer base of over 50 million members and a valuation of over USD 4 billion. With users across America and now Europe, Credit Karma could well soon be coming to a city near you.

#7

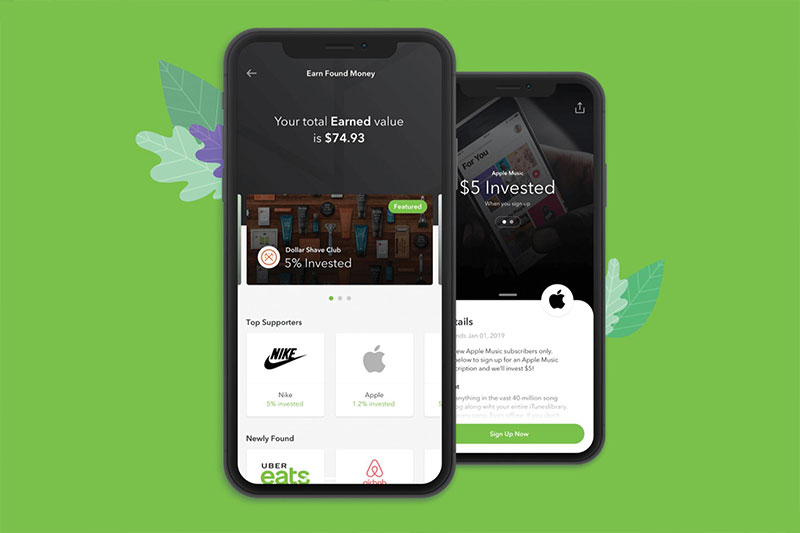

Acorns

Acorns is a US savings and investment app that saves and invests its users’ spare change. You simply connect your credit or debit card(s), and the app automatically rounds up (to the nearest dollar) whenever you spend, investing the difference for you. With an impressive user base of 4.5 million as of 2019, Acorn is valued at around USD 900 million and available for use in the US and Australia only.

#8

Neat

Based in Hong Kong and operating globally, Neat is a faster, friendlier, and more modern digital banking alternative. Neat gives you a unique prepaid Mastercard that you can use worldwide – great for travellers, students, and people who are tired of dealing with banks.

Your Neat card is linked to an app which tracks all your transactions in real time, from top-ups to payments, and automatically organizes them into categories like Food, Groceries, and more.

FinTech is making personal finance so much easier.

These days, managing your finances doesn’t have to be a headache. Hopefully, these apps make your life a little easier. Let us know how you find them!

Related Articles

Pundi X: The FinTech Firm Helping People Across Asia Regain Control of Personal Data

What Ant’s IPO Suspension Means for Future FinTech Growth

FinTech Unicorn Airwallex Secures USD 160M Series D Funding

About Our Contributing Author

Joshua Chong is a Marketing Specialist at Neat. Neat’s mission is to take away the obstacles typically faced in dealing with banks: the paperwork, bureaucracy and long processing times. The first of its kind in Asia, Neat provides business accounts for startups, entrepreneurs, and SMEs, as well as personal accounts for individuals.