Garnering over 700,000 registered users within a year of its XWallet app launch, FinTech company Pundi X is giving users back the control they want over their own data, starting with their latest release of the world’s first blockchain phone. CEO Zac Cheah explains his vision.

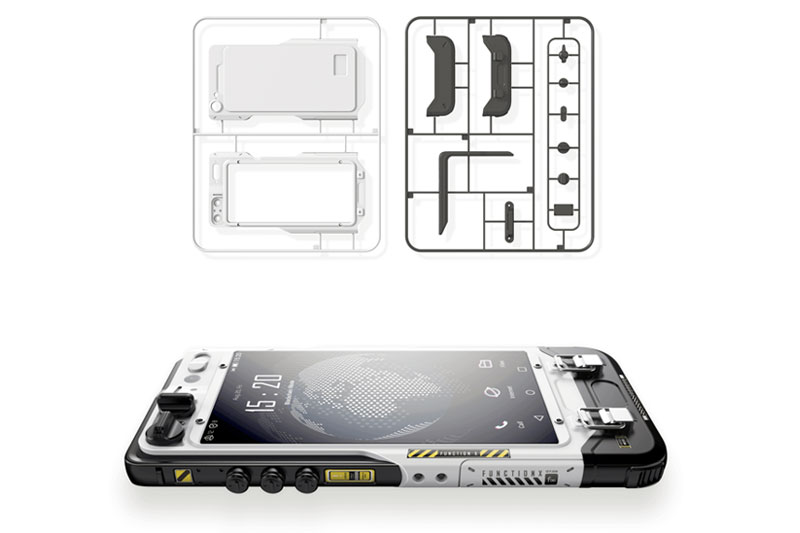

Determined to stand out in the blockchain landscape with their self-professed mission to make blockchain technology as universal as the Internet, FinTech company Pundi X has invented the world’s first blockchain phone, Blok on Blok, otherwise known as Bob. Fresh from a win at Las Vegas’ 2020 CES Innovation Awards, the technology has been designed under the company’s philosophy of ‘owning your data.’ Built as a personalisable blockchain phone, Bob is powered by the decentralised network ‘Function X,’ giving its users the ability to use cryptocurrency in their daily lives. As CEO Zac Cheah puts it, “The blockchain phone is not just a phone. It’s a representation of what is possible.”

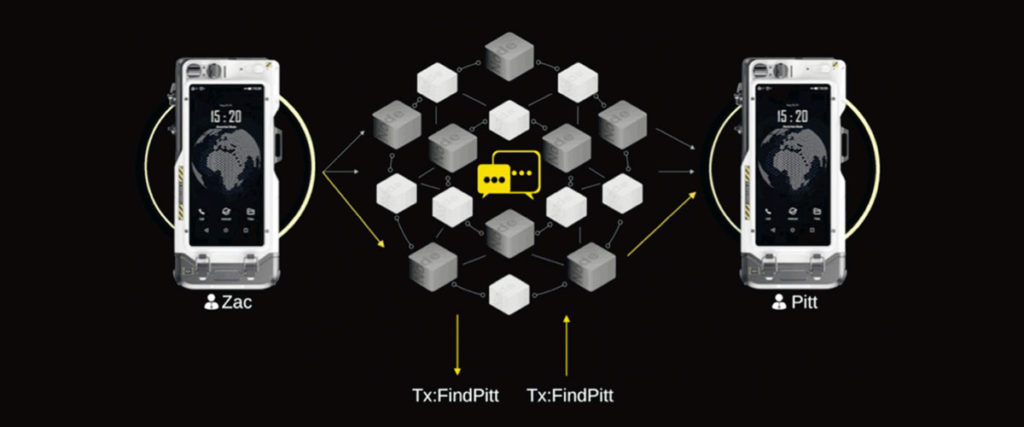

“In today’s age, our data is being sold to different companies like Facebook and telco,” explains Zac of the main threat that Bob seeks to disarm. “We can create a decentralised social media network, a decentralised phone call – which is, of course, encrypted, so you hold the data. It’s not Facebook. It’s not Uber. It’s not the government. It’s yours.” To do that, they have used blockchain technology so users can call, text or browse without a centralised service provider that store personal information. “What we want to do with Function X is to decentralise everything. So much so that even our company doesn’t own the blockchain; the blockchain is owned by the people.” Launched in Q4 2019, Bob’s technology allows its users to bypass all centralised service providers that store personal information – and is currently available to be pre-ordered on crowdfunding platform Indiegogo and via PundiX’s app, XWallet, for USD 535. Each order comes with an easy to use MOD Assembly Kit, allowing buyers to tweak certain aesthetic elements of their phone, and extremely keen amateurs to even 3D-print extra elements. Operating on a dual blockchain/Android system, users can switch between both and can even access decentralised versions of their favourite Android apps.

Prior to the creation of Bob, Pundi X focused on providing mobile app-based payment solutions for unbanked populations, particularly for the Indonesian market, where close to 70% of the population don’t have a bank account. But the company soon pivoted to blockchain when Zac saw the opportunity to complement the company’s existing hardware with blockchain infrastructure. True to the company’s vision of “making cryptocurrency accessible to everyone,” Zac envisioned a decentralising framework for all data, beyond the current realm of blockchain currency. “What does this mean exactly?” he clarifies, already one step ahead. “If you run a Function X server, you and tens of thousands of other people own part of the blockchain. We don’t need to trust a central entity for the issuance of cryptocurrency because the trust is basically verified by different players in the ecosystem.” Secured by its democratised nature, Zac explains that it is impossible to falsify a block of information as this would mean making an entire chain for a million possible scenarios.

You might also like Gaming Company Razer’s CEO on FinTech for Gamers in SEA

To deliver on this offer, Pundi X have developed several components as a part of their business ecosystem: the crypto mobile application XWallet, a contactless smart card called XPASS, and XPOS (Point of Sale) cryptocurrency payment terminals, all of which have been designed to make it as easy as possible for both shoppers and retailers to start buying, using and selling cryptocurrency. So far, Pundi X’s XPOS terminals can be found in over 30 markets from Sao Paulo to Singapore where they are used for real-time transactions and can support over 20 different cryptocurrencies. “We are one of the biggest, if not the biggest, crypto card provider in the market,” says Zac.

For Pundi X, a future in which this kind of payment system becomes the norm is not as far off as one might imagine. As they see it, migrating to the use of a crypto card is not as big a leap as some consumers may think. “A crypto card is just like a credit card; they don’t need to understand how to store private and public keys,” explains Zac. Instead, customers can turn to the contactless payment card XPASS, which goes hand in hand with Pundi X’s mobile payment app XWallet. “It’s a very similar presentation of what they already understand,” he says. “In Singapore, we already have GrabPay, GoPay, and banks providing solutions. People are moving to cashless payment and that is the precondition to digital currency adoption.”

For all his assurances that a blockchain Internet can change the way the world is powered, one of the biggest hurdles Zac has to face is a still-deeply-cynical public. High-profile scandals have rocked faith in a currency that people can’t actually see – and therefore find hard to quantify. “It’s something that everyone wants to figure out: how do we regulate FinTech or digital currencies?” Zac muses. First, he says that the industry needs to remove malicious players within the system. “It’s a huge challenge, but governments are taking steps. Industry players are taking steps. Key operators are forming FinTech Associations to stamp out bad players.” In addition, he thinks a period of adjustment will help increase the public’s awareness of making transactions this way. “During the birth of the Internet, a lot of people were like, ‘Hey, you know, it’s illegal to browse the Internet,’ or when we moved to mobile banking, people were asking, ‘What if the bank shuts down?’ or, ‘I’ll feel safer if I physically go to the bank to withdraw money.’ But today?”

As they move to expand their reach as quickly as possible, Zac realises that Bob and everything that goes with him will stand or fall on his actual use. “Moving forward, many cryptocurrencies in the market will be judged based on real business use cases. Demand can come from trading or speculation, but also real business demand, which is what we want to focus on,” he explains. With their expansion from XPOS to XWallet to XPASS and their decentralised network Function X, Pundi X continues to extend the breadth and accessibility of their products for people from all walks of life. “Maybe one day we will be as ubiquitous as the Internet,” Zac says. “I think 2020 will be a very exciting year for currency and blockchain. We hope to throw in more use cases to give normal people the access they need to enjoy the benefits.”

Related Articles

MioTech: The Asian FinTech Company Built on AI, Sustainability and Friendship