Did you know that 80% of Australians have never received any financial advice? Australian FinTech firm Clover is on a mission to change that, opening up opportunities for Australians to save more – and earlier – with fewer costs.

Sahil Kaura, Harry Chemay and Darcy Naunton want to make financial advice much more accessible for the average Australian with their FinTech company Clover. Peeling away the unnecessary layers of administration, they are streamlining the process of making investments with technology, focusing on stable, long-term returns. It’s a timely proposition. With interest rates as low as they are today, the trusty tactic of putting your savings in a high-interest account is no longer a viable option for making your money grow. As Clover CEO Sahil explains, “After inflation and taxes, your high-interest savings account is largely flat to potentially going negative in real terms.” Offering an alternative, Clover is creating a new, technology-driven space where customers can create their own diversified investment portfolios, offering digital advice in a bite-sized, highly accessible format. With over four decades of experience in the financial planning and venture capitalist industries between them, the three founders came together four years ago to answer one simple question: “How do we give good advice to young people?” And so their brainchild Clover was born.

The trio first met at the global consulting firm Mercer where they advised some of the largest funds and insurance companies in the country on investment-related matters. Equipped with one of the largest databases of fund manager performance in the world, Sahil recalls, “We realised that active management such as stock-picking wasn’t necessarily creating better long-term outcomes. A lot of the data we were seeing showed that over a short period of time, yes, you could sort of outperform the market, but when you looked at sufficiently long periods, it was actually very, very hard.” In addition, it became increasingly apparent that layer upon layer of administrative fees were being tacked onto the cost of investments. “We wanted to give people in their twenties and thirties access to some really smart, simple, transparent financial investment products early in their working lives, so that they could go into their forties and fifties feeling far more confident about their financial futures,” Sahil explains of their motivations.

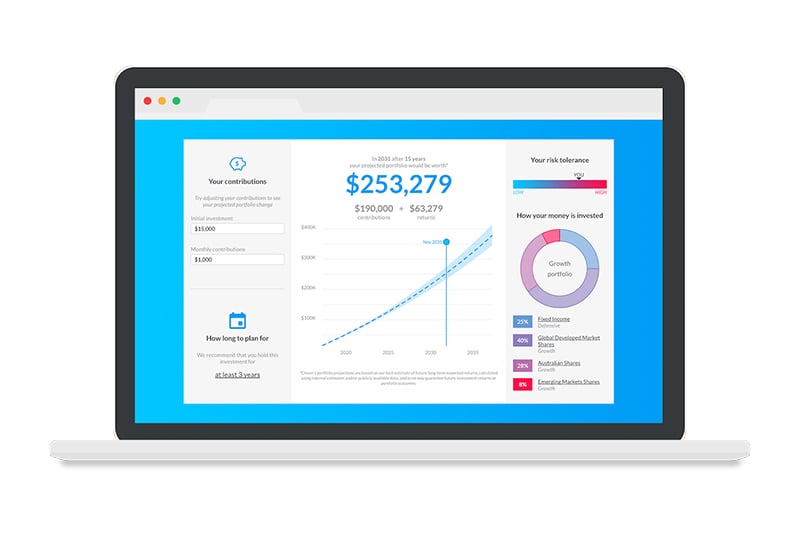

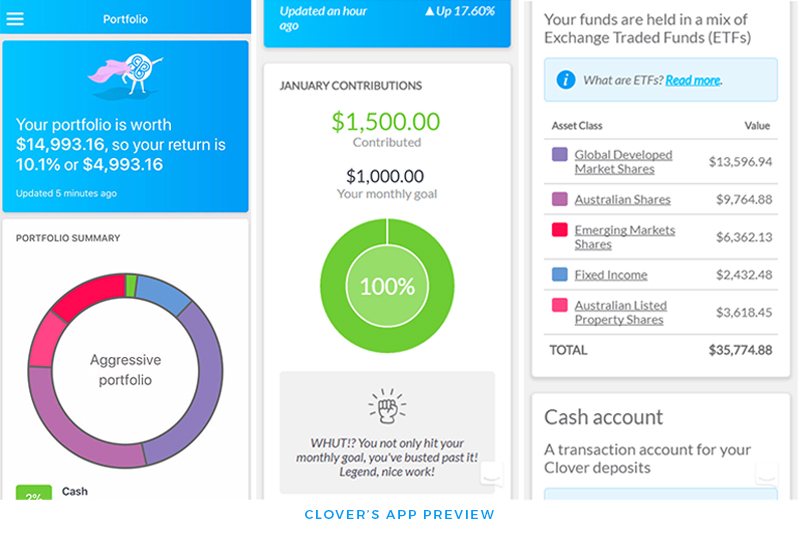

Introducing a user-friendly experience as intuitive as Uber or Airbnb, Clover offers quality financial advice whilst keeping things simple. Signing up takes less than 10 minutes. Each user is guided through a risk assessment questionnaire. Then, Clover recommends a portfolio based on their risk tolerance and shows them the trade-offs involved (i.e. risk and return). If the user is comfortable with the portfolio, they provide their details, transfer the money, and voilà. The investments are made in their name the very next day. Currently, Clover’s platform is only available for use in Australia.

In essence, Clover is all about removing barriers, making it affordable and accessible to create a diversified investment portfolio. Combining human expertise with algorithmic efficiency, they aim to bring costs right down whilst maintaining consistent investment performances. The company builds their portfolios with Exchange Traded Funds (ETFs) which combine the best aspects of managed funds (low cost plus admin efficiency) with the transparency of listed shares (as ETFs are listed and trade every day). With relatively low fees, ETFs hold an advantage over other investment options considering the importance of keeping costs low. “For most of us, we kind of think, ‘Oh a 1% difference in fees. What would that mean?” Sahil explains. “But a 1% difference in fees over a 30 to 40 year period means that AUD 100,000 on a given return is essentially AUD 60,000. So, you’re losing 40 to 50% of your end balance, just by having a 1% difference in fees.”

Sahil favours simple, well-diversified investments over more volatile high-risk, high-reward strategies. “Just like with health fads, it’s far more sustainable to stick to simple rules that will reap consistent results. People tend to get excited about something that will double their money in x amount of time, or take a lot of risk so that they can grow their money very quickly – those kinds of strategies don’t really work.” He advises people to aim to save 30% or more of their salaries, but emphasises the importance of getting started above all else.

Simplicity is core to Clover’s design, incorporating gamification to encourage users to adopt healthier saving habits. Sahil relates, “We have a really simple user experience around how ‘you save this much, this month.’ And over time, we’ll add more markers around how ‘people in your age group with your income are saving x and you are here’ so let’s give you some gentle positive nudges to get you in the right direction.”

Although Clover offers digital advice, Sahil is quick to stress that Clover still doesn’t do away with the human element which is “a core part of our investment philosophy.” Each model portfolio is crafted by an investment committee headed by Dr Jack Gray, named one of the top 10 investment academics globally. It’s the committee that sets the model portfolio, looks at all the risk modelling and agrees the objectives. Only once they have signed off on the portfolio do the algorithms come in. The algorithms, on the other hand, are simply gatekeepers, implementing these portfolios, monitoring the risk limits, and making sure they’re staying within target.

Robo-advice, also known as digital advice, has become increasingly common in the last decade among investment circles. Touted as a means of engaging people much earlier on, the technology has gradually overcome initial hesitations within the financial advisory sector. Experts have since acknowledged that better outcomes for end users could be achieved if digital advice and financial advice work together. For now, the founders are working to adapt Clover to be in line with variations in international financial regulations. As they scale globally, they hope to meet “a universal need” – helping young people access smart, simple investments early in their working lives.

Related Articles

9 Leading FinTech Entrepreneurs in APAC

How To Register Your Business in Australia

Melbourne University’s New VC Fund Tin Alley Ventures Set to Back Alumni Founders