Chinese e-commerce giants Alibaba and JD.com have both seen their stock prices break historic records following quarterly financial results released last week.

Alibaba’s stocks (HKG: 9988) soared to an unprecedented high on the Hong Kong market, opening at HKD 270 (USD 34.84) this morning. JD.com (HKG: 9618) has also seen a substantial spike in price since last week, opening at a record HKD 299 (USD 38.58) today.

The bullish investor optimism comes after the companies released their latest financial reports, which reflected China’s strong economic recovery, with both revenues and incomes seeing substantial growth, relative to the same period last year.

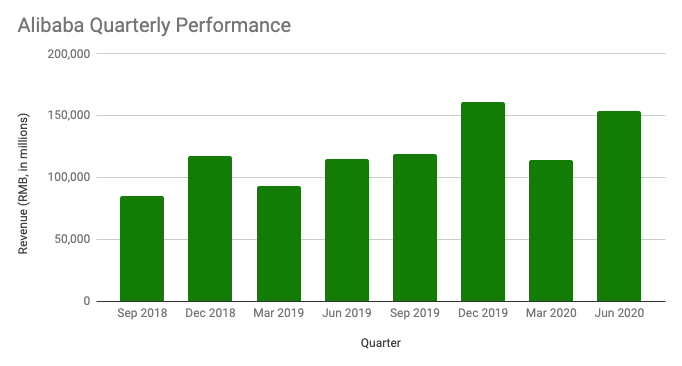

Alibaba, which commands a 55.9% market share of China’s e-commerce industry, reported quarterly revenues of RMB 153.8 billion (USD 21.8 billion) – a 34% increase year-on-year. Net income also increased to RMB 47.6 billion (USD 6.7 billion), up 123% from the same period last year.

Alibaba CFO Maggie Wu attributed the growth to the company’s continued success in China’s domestic market, explaining, “Our domestic core commerce business has fully recovered to pre-COVID-19 levels across the board”. In addition, like Amazon, Alibaba has invested heavily in cloud computing, with quarterly revenues increasing by 59% year-on-year.

Photo Source: Hive Life

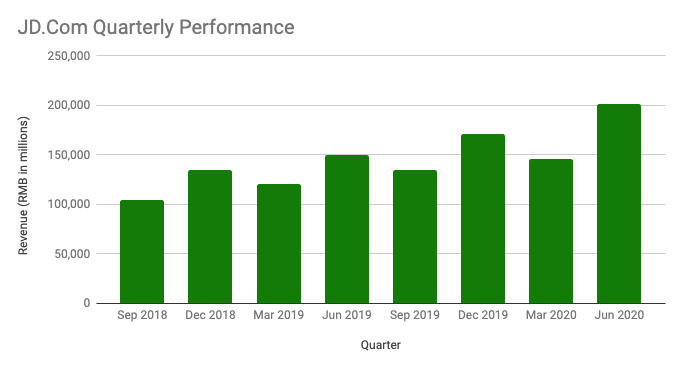

JD.com’s quarterly revenues were also up 34% year-on-year, coming in at RMB 201.1 billion (USD 28.5 billion). Net income was at RMB 16.4 billion (USD 2.3 billion) – a remarkable increase from the same period last year, which raked in an income of RMB 0.6 billion (USD 90.1 million).

Livestreaming has increased in popularity as a consumer engagement tool for businesses, especially amidst social distancing precautions, and JD’s Instant Delivery service for mobile products could be the first step to honing a competitive edge in specific industries.

Photo Source: Hive Life

China’s e-commerce industry has seen a remarkable recovery since the onset of the COVID-19 pandemic, with the industry adapting quickly to changing conditions and key metrics now surpassing pre-COVID levels.

China marketing specialist Ashley Dudarenok predicts that “Alibaba, JD and Pinduoduo (PDD) will continue to show optimistic results and robust growth in 2020. While Alibaba is still secure in its industry leader position, it’s exciting to see how JD has been catching up this year.” JD.com has tripled its market share relative to Alibaba since 2014, according to 2019 figures, going from 10% to 30% of Alibaba’s gross merchandise value (GMV).

However, although e-commerce is well-placed to thrive amidst an increasingly digitalised society, the industry still faces threats from a further virus outbreak, which could cause logistics disruptions, slowed economic activity, and threats to merchant solvency – all of which the e-commerce industry hinges upon.

Related Articles

How E-Commerce Will Help Asia’s Post-COVID Recovery, According to Industry Experts

The Future of Retail: 2020 Industry Trends from E-Commerce Expert