Cathay Pacific’s stocks rose 4.9% yesterday after the Hong Kong flag carrier announced plans to axe 8,500 jobs globally in an HKD 2.2 billion restructuring plan.

• The airline saw its prices jump to a month-high after investor optimism rallied.

Why it matters: Analysts are optimistic as Cathay’s drastic move will reduce the firm’s monthly costs by approximately HKD 500 million in 2020 and allow the company to survive, despite a difficult year. The firm has reported significant monthly losses of HKD 1.5 to 2 billion, due to COVID-19 induced restrictions on travel.

• Investment bank Daiwa Capital Market described the restructuring as a “positive catalyst to the share price”, upgrading ratings to Buy.

• However, this move has also sparked fears of a domino effect, as many anticipate other corporations to follow suit.

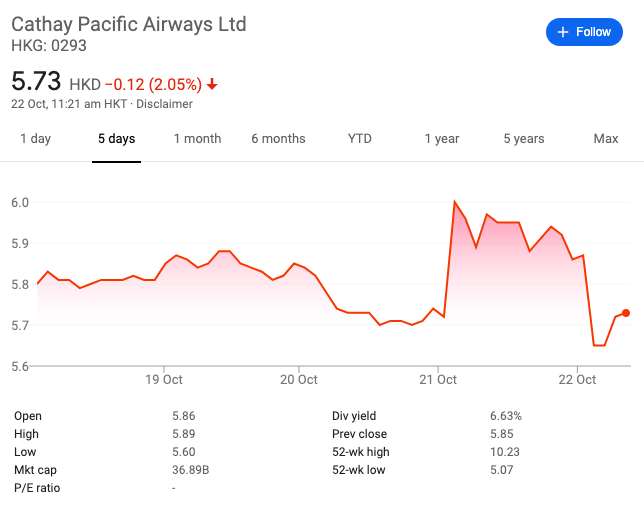

More details: Cathay share prices jumped from HKD 5.72 to HKD 6.00 Wednesday morning. However, the share price dropped again to a low of HKD 5.65 before rebounding slightly on Thursday morning, possibly marking a sell-off from longer-term shareholders.

• Cathay Pacific’s share prices have fallen over 40% since the beginning of the year, from HKD 9.93. Share prices bottomed out at HKD 5.09 in August, correlating with Hong Kong’s third wave of COVID-19 cases.

Cathay’s restructuring plan: Cathay will axe 8500 job posts globally, 5300 of which will be from Hong Kong alone. Operations of its subsidiary airline, Cathay Dragon, will also be ceased with immediate effect.

• Nearly all Cathay Dragon staff will be terminated. Remaining cabin crew and pilots will be asked to sign new, lower-paying contracts.

• Laid-off employees will receive an extra month’s salary and be compensated for the compulsory unpaid leave, according to Cathay Pacific’s Flight Attendants Union.

By the numbers (according to Cathay’s 2020 Interim Results):

• Loss: HKD 9.8 billion

• Decrease in Passenger Occupancy: 98%

• EPS: 0.43

• Market Capitalisation: 36.75B

What’s next: Cathay forecasts it will operate at below 25% capacity level during the first half of 2021, but the group expects a moderate recovery in the latter half of the year.

• “Based on IATA predictions, passenger travel will not return to pre-COVID-19 levels until 2024,” revealed Patrick Healy, Chairman of the Cathay Group.

Related Articles

FinTech Giant Ant Group Granted HK Approval for $30B IPO Dual-Listing

China’s Latest Export Ban Restricts Sale of Advanced Technology, Strategic Materials

Australia Discusses Quarantine-Free Travel With Japan, Singapore, South Korea