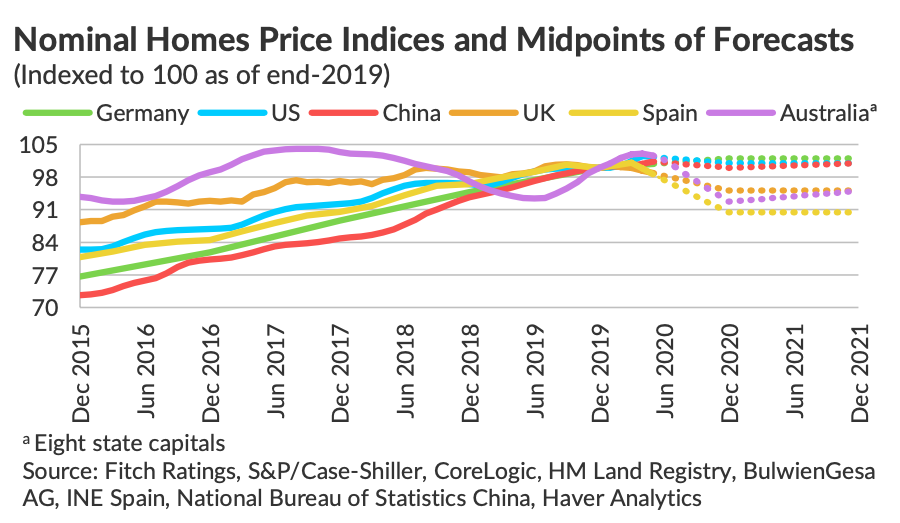

Australia, Spain and the UK face falling house prices in 2020 due to the pandemic, according to Fitch Ratings.

The US, Germany, and China are also anticipated to have mostly flat house prices, although China will be least affected by the coronavirus. Demand for housing is expected to decline in most countries this year as a result of the virus, even as lockdowns are lifted.

According to the newest 2020 forecasts, Spain will be hardest hit, with house prices dropping by 8%-12%, followed by Australia, which will see a 5%-10% decrease. The UK will also experience a 3%-7% drop, provided a cliff-edge Brexit does not occur. All three countries have seen a downward revision in their forecasts.

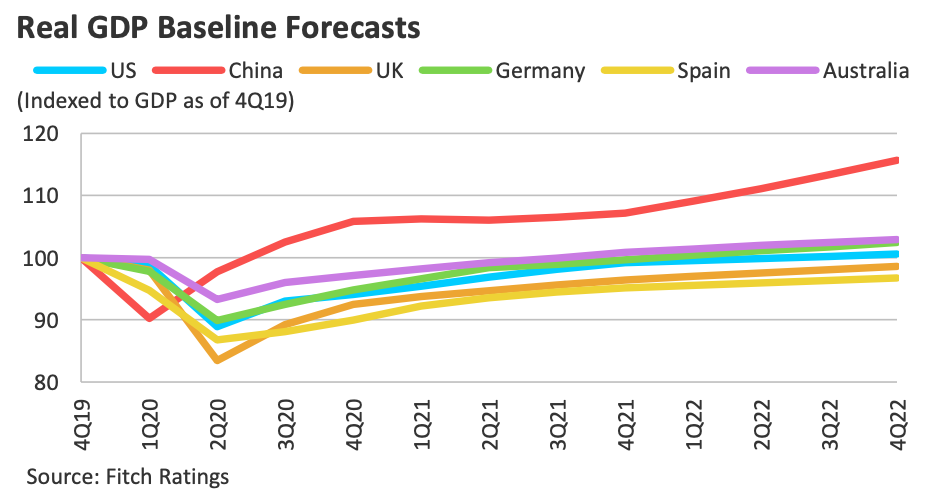

The drop in real GDP and rising unemployment rates in many countries are both contributing factors to the decline in demand. Spain’s unemployment rate is forecast to be at 18%-19% in 2020 and 2021, up from 14% in 2019. The US unemployment rate is expected to be at 9% in 2020 and 8% in 2021 – double the 4% unemployment rate in 2019.

On the flip side, China’s strong housing demand, swift reopening, reduced mortgage rates, and lifting of regulatory restrictions have placed it in a strong position to maintain housing prices, which are expected to remain stable through 2020 and 2021. In addition, current record-low mortgage rates in the US and Australia will also help to insulate their national markets from further drops in demand.

More generally, the housing market could see a revival next year. “We expect sales volumes to recover from 2021, when we broadly forecast prices to stabilise, although Australia could have a slightly larger home price rebound,” the report states.

Economic recovery depends largely on the extent to which the coronavirus is successfully contained – and the scale of disruption caused by any further lockdowns. As cases remain high in the US, the report warns that “Markets that reopened too quickly face more downside risk from the re-imposition of restrictions and resultantly weaker labour markets.”

Falling house prices could have a knock-on effect on consumer confidence, which has seen a record drop in Q2 2020 since the pandemic hit. Although the global economy is expected to recover slowly after the April trough, consumer spending may take longer to resume pre-COVID levels, given the demand-driven recession.

Related Articles

Japan Reduces Dependence on Chinese Factories, Spends ¥57.4B in Subsidies

Hong Kong Loses Special US Trade Privileges; Banking Sanctions Imposed