Hong Kong InsurTech company OneDegree offers an alternative to traditional insurance processes that promises to be cheaper, more efficient, and more convenient – an approach that’s being rapidly adopted by millennials.

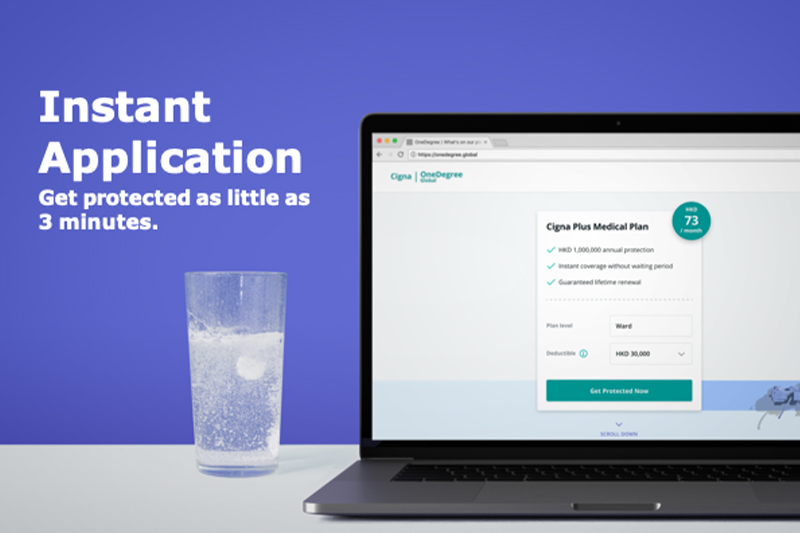

Digital insurance enables providers to shift from conventional working models, which involve days of manual grunt work, to a new system that processes claims in just a few minutes, or even seconds, allowing digital insurers to operate at a low cost. Factor in an online platform that appeals to younger, tech-savvy individuals who can take out a policy for just a few hundred Hong Kong Dollars a month, and could you have the future of insurance? Alvin Kwock, Co-Founder and CEO of Hong Kong-based digital insurance company OneDegree, makes the case for a new way of getting and providing insurance.

“I only had one full-time job that lasted 11 and a half years at JP Morgan as a banker,” says Alvin of his previous life. “About three years ago, my mother was suffering from late-stage cancer and I saw a lot of issues and inefficiencies with the way insurance companies handled health care. Talking to my mother’s roommate in the hospital, I learned that she had to take out a loan because the approval process for her insurance claim was taking so long. A digital alternative would make a massive difference in turnaround time and that’s why we wanted to get into digital insurance – to change the system fundamentally.”

Soon after, Alvin travelled to the United States to search for a solution in Silicon Valley’s InsurTech space – and that’s where he met Alex Leung, his co-founder. “I had meetings with all the big Insur-tech companies and came across Collective Health, one of the five largest insurance tech firms in the US. Alex Leung was a founding team member and we got along because we come from very different backgrounds. Alex has a solid technology background, whereas I was mostly working with the TMT (Technology Media & Telecommunications) sector on the banking side. We bring a very different group of people to the table.”

You might also like A Neat Alternative to Traditional Banks

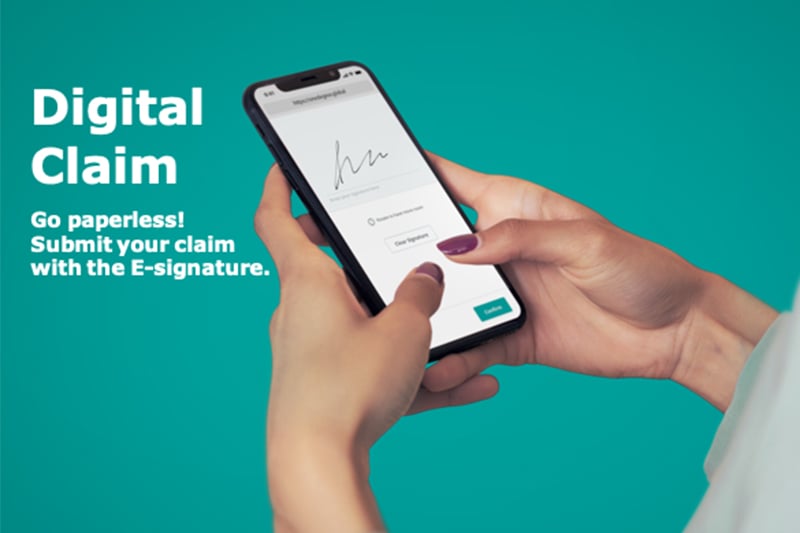

By reducing paperwork, manual labour and processing time, Alvin claims that they have streamlined the purchase process of insurance down to an impressive three minutes. He asserts that OneDegree is one of the few digital insurers in Hong Kong that’s not only digitised the process end-to-end, i.e., from purchase to making claims, but also provides medical insurance for pets in a highly underserved market. “While there are more than 500,000 pet dogs and cats in Hong Kong, only about 2% to 3% are covered by insurance, compared to 42% in the UK.” Products like pet insurance provide a massive opportunity for digital insurance to become the norm. “When it comes to proof of concept, we’ve worked with 20% of health clinics in Hong Kong and optimised according to the feedback we got. It’s imperative to get customer feedback and have the product endorsed by stakeholders in the ecosystem it’s meant for.”

OneDegree is currently listed among the top four companies in Cyberport’s Hall of Fame and announced in May 2019 that it had extended its Series A round to USD 30 million, up from their USD 25.5 million, announced in September 2018. Led by BitRock Capital, an investment firm that focuses on financial tech globally, they have sought funding from the Cyberport Macro Fund and Cathay Venture amongst others. “When it comes to being an insurer, you have to be able to pay for the claims, which is one of the reasons why our funding is higher than a typical startup’s,” explains Alvin.

The company intends to use the funds to scale its end-to-end digital insurance platform, expand on current product offerings in Hong Kong, and explore growth opportunities in the Greater Bay Area. It’s currently pending regulatory approval through the Hong Kong Insurance Authority’s new fast-track licensing program for online-only insurers. “We have plans to get into the SME space and are looking into cyber insurance. Right now, there are about 100,000 SMEs selling their product online and that implies dealing with a lot of data and businesses that are particularly vulnerable to cyber-attacks.” They have also invested in the implementation of augmented reality for customer service and user experience. “The best insurance policy isn’t just one that covers damages, but one that also helps with risk assessment, accident recreation, remote claims handling and customer education, and that’s where AR comes in. AR may also lead to meeting higher standards of customer experience expectations, especially when navigating the claim process.”

Alongside SMEs, it’s a whole generation of young customers that OneDegree hopes to resonate with. “With our current product, we have reached a demographic that a lot of companies have been struggling to reach, particularly people from 25 to 35.” And it’s a group that’s predicted to increase. Globally, the digital insurance platform market is expected to grow from USD 86.20 billion in 2018 to USD 164.13 billion by 2023. “Digital insurance in Hong Kong is still in its inception. Like the stock market, which took about 15 years to go fully digital, we expect that in about 10-15 years, conservatively, 50% of the market will be digitised,” says Alvin. Factor in the Greater Bay Area being home to 70 million people that are more technologically equipped and value a higher degree of personalisation and convenience and it’s not hard to see why OneDegree believe passionately in their offering.

Related Articles

8 Mobile Apps to Increase Your Productivity