Businesses may increase demand for satellite offices in decentralised areas, reducing real estate costs while maintaining operational efficiency. Dubbed the “hub and spoke” model by Colliers, the trend could benefit coworking spaces, which provide flexible leases.

IWG, the world’s largest serviced office provider, has reported “more enterprise accounts looking at greater distributed working” in its interim financial report, with a 3.5% year-on-year increase in revenue in the first half of 2020, which amounted to GBP 1.3 billion (USD 1.7 billion). However, the firm saw a substantial drop in profits, marking a GBP 13.4 million loss (USD 17.7 million), which reflected a difficult second quarter.

“In the new world of working post COVID-19, offices will still be needed but there will be a greater requirement for more flexible space,” Mark Dixon, IWG CEO, stated. “More companies will have distributed workforces with more satellite offices, more employees working closer to home or continuing to work from home.”

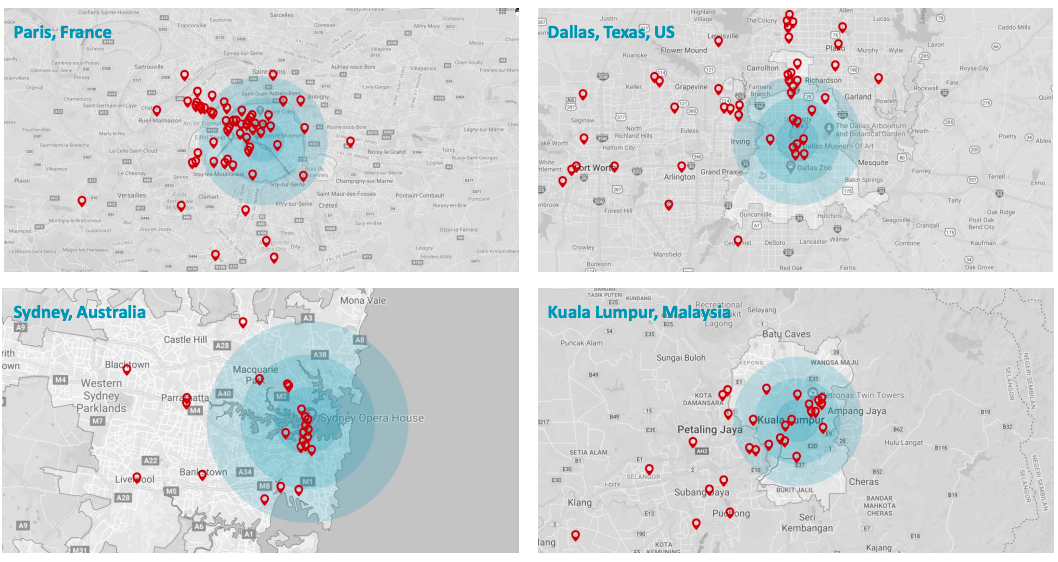

Decentralised IWG workplaces in Aug 2020 (Source)

The increase in remote and decentralised workplaces may cause a corresponding shift towards location-based salaries, which could help firms further cut costs. Facebook announced in May that it planned to adjust employee remuneration based on living costs, which would mean lower salaries for those who relocate out of major cities.

Furthermore, the accelerated changes in the industry have created a massive growth opportunity for new office space products, such as virtual memberships, that support home, remote, and decentralised working.

“With remote working becoming the new normal, we are seeing an increased rise in demand across all sectors – from large enterprises and MNCs to startups and freelancers,” Chris Edwards, COO at APAC coworking operator the Hive, commented. “We’ve seen 70% more leads in August compared to April and strong rebounds in demand when lockdowns lift.”

Operating models such as “flex and core”, where firms retain smaller central headquarters with the option to adjust capacity flexibly, and cross-location corporate access, which would allow employees to drop in and out of a geographically diverse network of office spaces, are expected to become increasingly popular going forward.

In addition, landlords have shown greater interest in working alongside operators to bring in additional revenue. “From the operator and growth perspective, both small and large-scale landlords are actively seeking revenue share agreements with regional operators to increase portfolio value and tenant amenities,” Edwards says. “We expect this to continue into 2021 and beyond.”

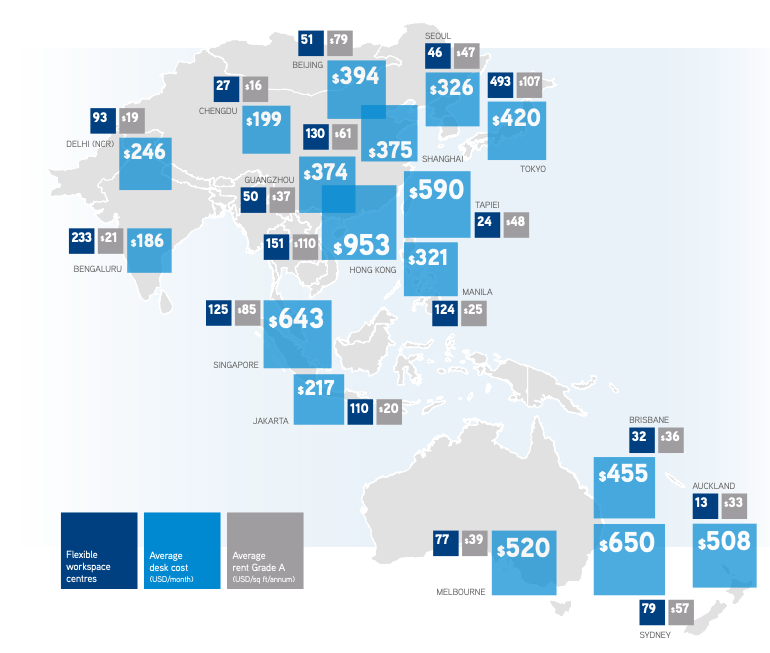

Asia Pacific Market Snapshot of Flexible Workplaces (Source)

In the longer term, the coworking industry is set to see some major shifts, with the potential for emerging international players to capture a greater market share.

“WeWork has started to hand back space in some markets, creating something of a power vacuum that will lead to a fragmentation of operator market share,” Colliers reports in its Flexible Workspace Report 2020. Now focusing more on cutting losses and consolidating its business model rather than aggressive growth, WeWork has gone from comprising 50% of operator take-up in Hong Kong and Singapore in 2019 to returning 20% of its Hong Kong leases to landlords this year.

In its place, mid-size firms who take on M&As to further strengthen their international footprint could become much more prominent in the industry, provided they are able to weather significant demand fluctuations in the case of further COVID outbreaks.

Related Articles

Future of Work Report: Will Remote Working Continue Post-COVID-19?