Looking to improve how you save and budget money? Read on to discover 7 budgeting apps designed to help you keep your spending on track.

It’s the boring, but essential, habit that most people could do with improving on – budgeting. Here are 7 apps that do the hard work for you.

#1

YNAB

Designed to help you manage your finances, YNAB (You Need A Budget) addresses all your budgetary needs from paying bills to helping you set savings goals. Dedicated to prioritising how you spend your money, its user-friendly interface and easy platform allow you to chart your monthly budget, import transactions directly from your accounts, and track your progress with handy graphs and reports. You can even share your budget with a partner.

#2

gini

A Hong Kong-based startup, gini is an all-in-one personal finance management app which links all your bank accounts onto one single platform, allowing you to track your finances, save money and gain rewards based on your spending habits and preferences with ease. With the aim of making finance simple and stress-free, gini makes use of AI to track your spending habits and make recommendations based on this information.

#3

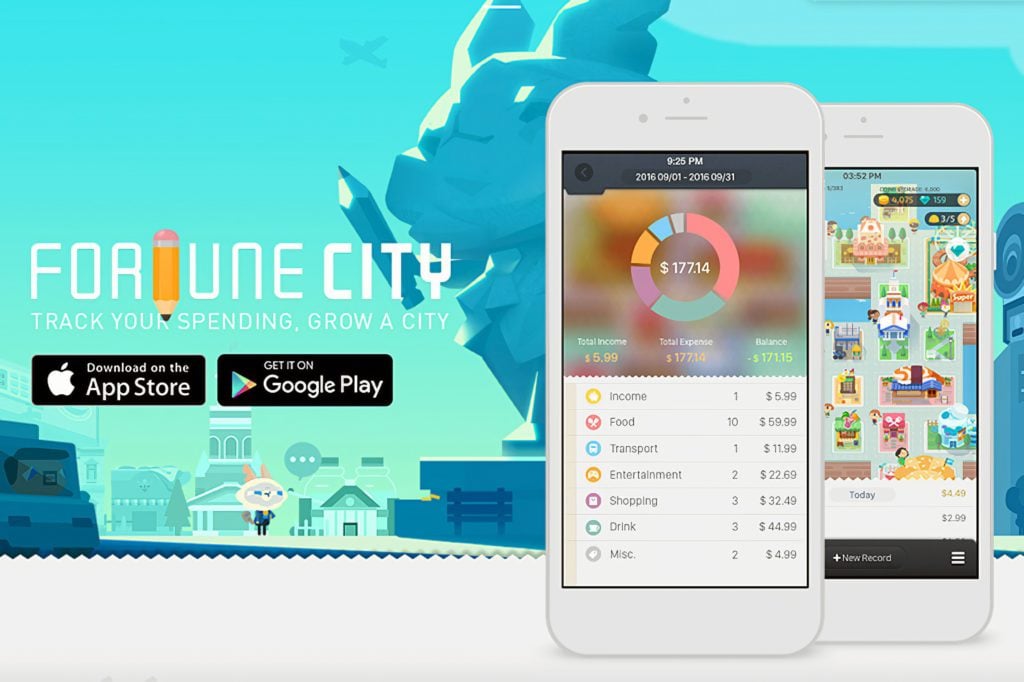

Fortune City

Putting a gamified spin on the bookkeeping experience, Fortune City offers an adorable, vibrant interface that transforms otherwise tedious tasks into fun and interactive activities centred on building your own city. With each expense tracked, you can build and watch your city grow over time, as well as unlock achievements as your monthly savings increase. You can even compete to develop the most lavish metropolis amongst your friends.

#4

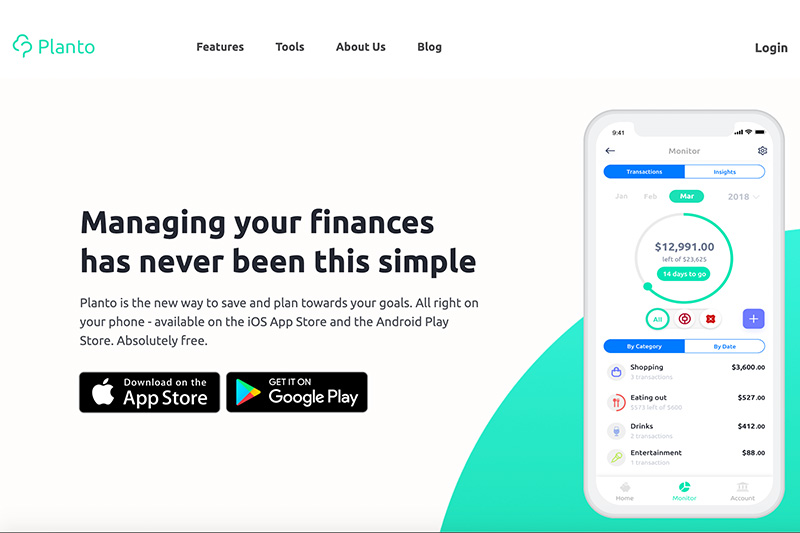

Planto

Targeted at millennials who are looking to stay on top of their spending, Planto is a Hong Kong-based finance management app that helps with expense tracking, setting financial goals, budgeting and more. This app offers a one-stop solution by consolidating all the information from your various financial accounts into one organised platform, offering simple and actionable advice to users, as well as giving insights into their financial behaviour.

#5

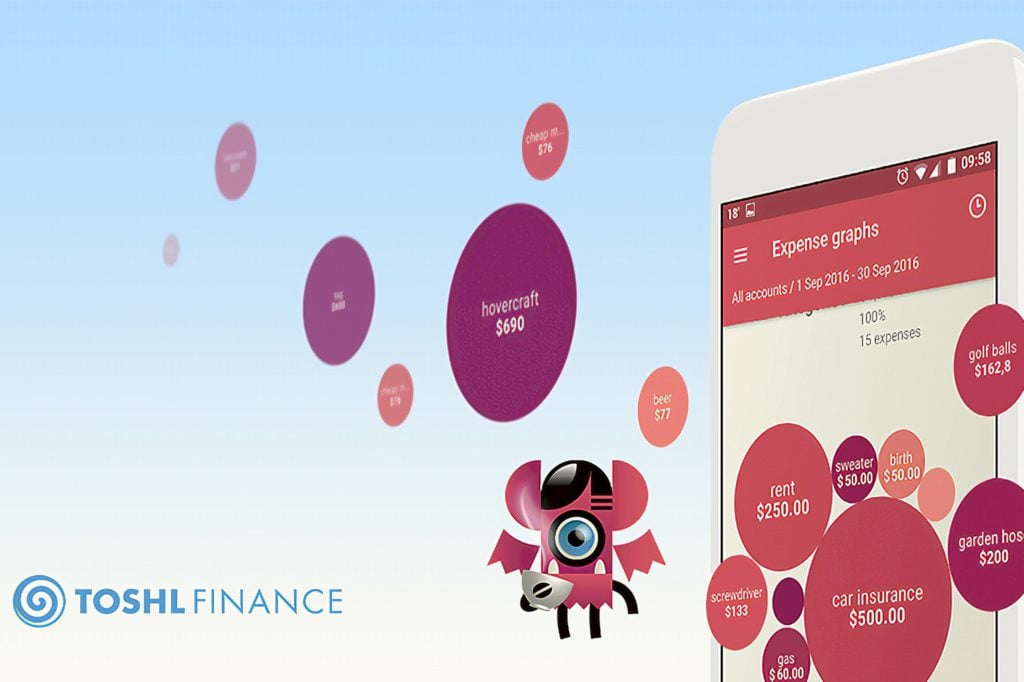

Toshl

With an easy and intuitive design, Toshl is a personal budget and expense tracker which allows you total control over your information. Rather than linking to your bank accounts and automatically retrieving debit and credit card transaction data, here, you can manually input just the information and expenses you want to track with the app, allowing for a more personalised experience.

#6

Goodbudget

Based on the ‘envelope system’ of budget planning, which involves allocating your income into different categories for monthly spending, Goodbudget puts your spending into perspective by breaking down your budget into two virtual envelopes: ‘regular’ envelopes for your frequent monthly spending, like rent and groceries, and ‘more’ envelopes for occasional expenses and savings like gifts or vacations. The app also offers an option to sync and share your data with a partner so you can budget together.

#7

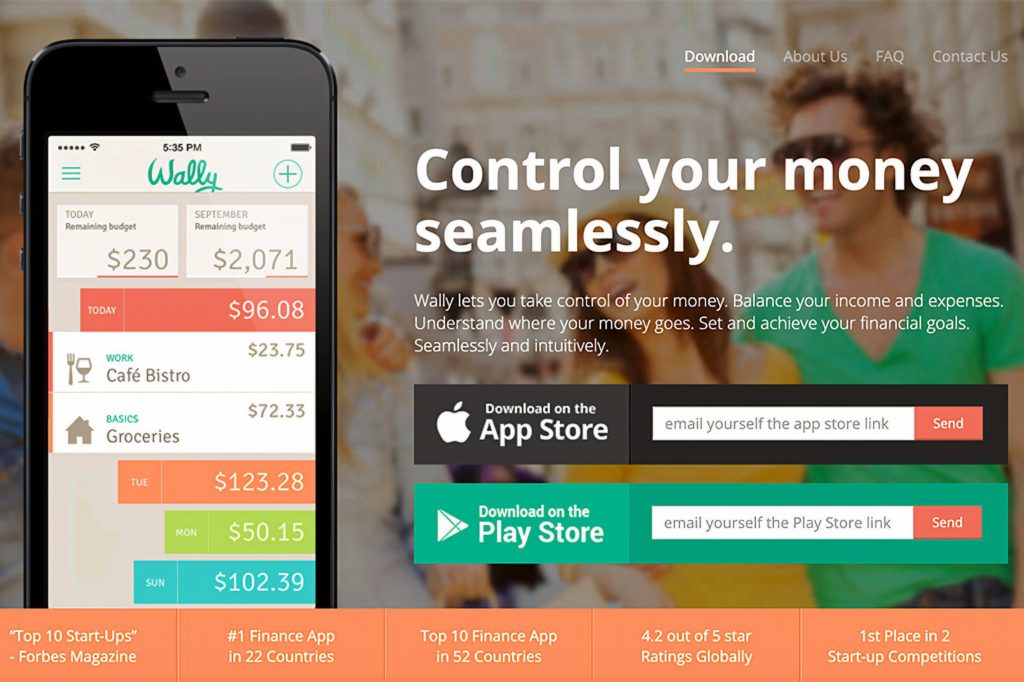

Wally

Since being named one of the Top 10 Startups by Forbes Magazine in 2013, Wally has continued its success, and still reigns as the world’s highest-rated personal finance app on iOS. This app provides a simple solution for managing your day-to-day finances. Based in Dubai, it offers a clear interface designed to streamline financial upkeep, helping to track your income, spending and set budgets. Looking to save time as well as money? Wally simplifies expense tracking with its unique feature InstaScan, which allows you to scan your receipts rather than input your spending manually.

Related Articles

The New Savvy Empowers 100M Women To Gain Financial Independence