A platform for digital creators, crypto opportunism, or just another overhyped trend? Let’s talk about the latest blockchain art trend: NFTs.

The coronavirus pandemic has been hard on all in-person experiences, and like any other institutions, the art world has had to adapt. Galleries, museums, and art fairs shut their doors in fear of outbreaks, prompting a reluctant yet exciting move to the online realm — a migration that has given independent digital artists a space to thrive.

Then blockchain’s crypto art, NFTs, completely changed the game.

What is an NFT?

NFT stands for Non-Fungible Token. Non-fungible means non-replaceable, one-of-a-kind. Blockchain art has to be non-fungible because it is the process of purchasing digital commodities such as music or drawings, and most commonly, art. This is why NFTs have to be stored on the Ethereum blockchain, a digital ledger that certifies the authenticity and ownership of a digital asset. This verification mechanism allows you to “buy” a digital commodity that is registered or “minted” as an NFT, whether it is a piece of digital art, a song, a New York Times column, or a Tweet.

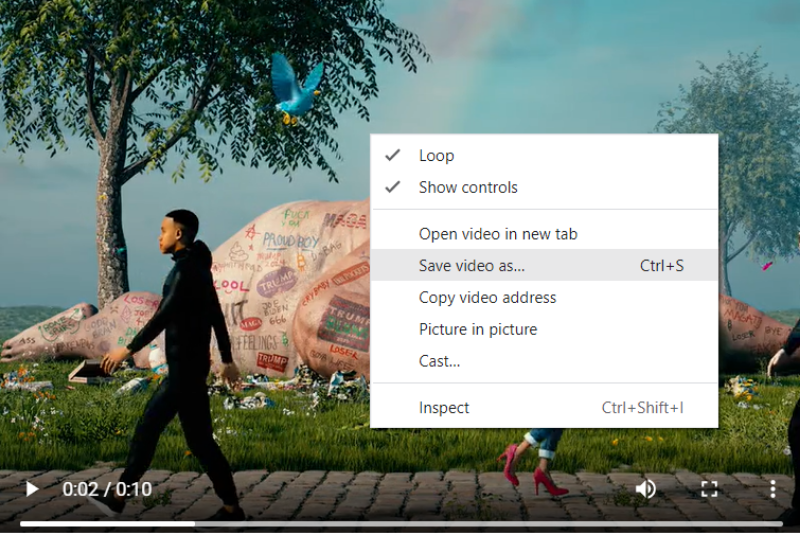

But why is there a sudden interest in digital art now that it is being sold as NFTs? Fundamentally, it does not really make sense — nothing is stopping anyone from right-clicking and saving Beeple’s CROSSROAD #1/1 as an MP4 file without actually paying for it. The concept of ownership has always been an amorphous point of contention in the art world, and the NFT craze has once again brought this dilemma to the forefront of the discussion.

Why are People Making NFTs?

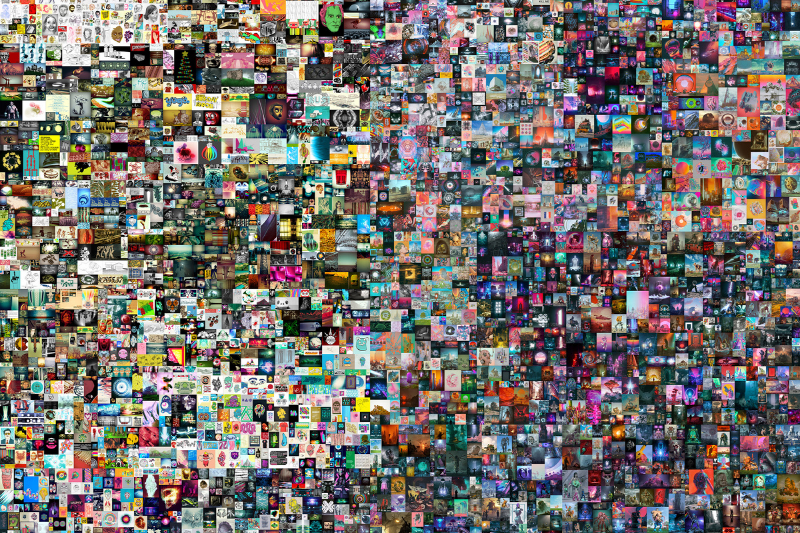

In theory, NFTs allow artists to sell their work on an alternative platform. People have bought NFTs for millions of dollars, and on top of that, artists can also earn a commission every time their work is sold, which also applies to resales. You may have heard of multi-million dollar sales like Beeple’s Everydays: the First 5000 Days which has been extensively covered and publicised. The hype around these sales popularised the idea that artists were finally able to make the money they deserved, prompting participation in the NFT market as well as investment in Ether, the cryptocurrency generated by the Ethereum blockchain.

How Much do Artists Make?

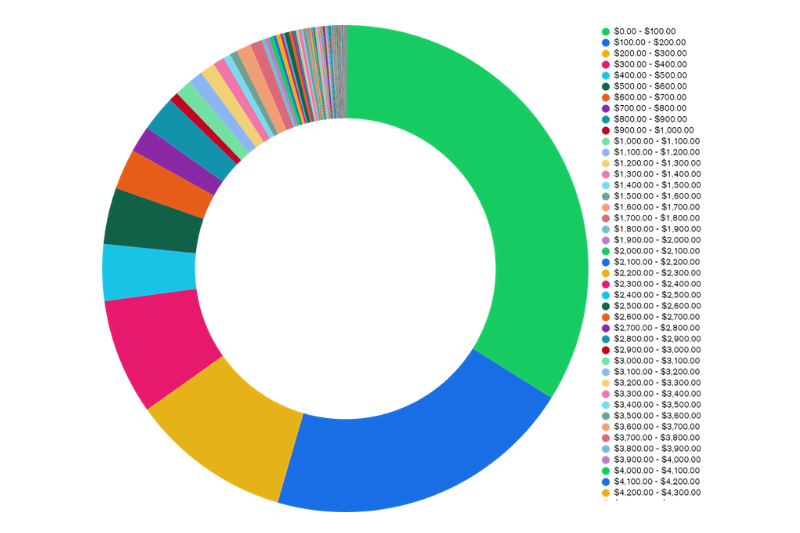

Unfortunately, Beeple’s NFT sales are not a very accurate representation of the market. In fact, these monumental sales only represent a very small proportion of the NFT economy. NFT artist, Kimberly Parker, dissects the illusion that artists are making more than they really are off of NFT sales, noting that the mean price of an NFT sale on the most popular NFT sites is surprisingly high — several thousand dollars. But the average sale is skewed by a small number of gigantic sales like those of Beeple, and a vast majority of NFTs are sold at prices far below the thousand-dollar mark.

The number of primary sales at a given price range. Source: Kim Parker on Medium

That being said, even though the average artist is not making as much from NFT sales as they were initially led to believe, they are still selling their work. There is another caveat, though: whenever an NFT is minted, the artist (or whoever is registering it) has to pay a variety of fees including something called a “gas fee”, which shaves off a proportion of the sale itself. For a third of artists, these fees could cost over US$100 for NFTs that sell for an average of US$100.

The NFT market, like the traditional fine art market, is highly imbalanced, with a great deficit of art piece profits actually going back to the original artist. In fact, NFTs raise the same issues as the traditional art world, but have simply uploaded them onto a crypto platform. But at the end of the day, it is a valid alternative market where artists can sell their work and make a profit — that is, with a thorough understanding of how the system works.

The Climate Controversy

It is no secret that cryptocurrency transactions are extremely taxing on the environment. This is because mining and transactions are made possible through a process called “proof-of-work”. Since there are no third parties that oversee Ethereum transactions, energy-hungry computers must be used to solve complex puzzles that allow the addition of new verified transactions to the blockchain (hence, proof of work). Badly optimised algorithms or outdated software aren’t the reason why blockchain eats up more electricity annually than the whole of Argentina, though — they are highly energy-consuming by design so that ledger entries and cryptocurrencies are better protected against cyberattacks. To combat this unsustainable practice, the Ethereum blockchain is moving from proof-of-work to a more energy-efficient mechanism called proof-of-stake, which will “see a greater than ~99.95% reduction in energy use post-merge,” Ethereum Foundation researcher Carl Beekhuizen wrote in a research report.

You’re a Buyer/Investor

Under ETH 2.0’s upcoming proof-of-stake update, instead of mining currencies with power-hungry rigs, potential validators “stake” a certain amount of coins into the network as a deposit — the higher the stake, the higher the chance of getting chosen to validate transactions, which then rewards validators with an amount of Ethereum. While the entry barrier to proof-of-stake is considerably lower than that of proof-of-work mining, as validators do not need to spend massive sums of money on mining rigs and electricity bills, the fact that inequality is ingrained in the system makes the Ethereum-rich richer. Andres Guadamuz, a senior lecturer in intellectual property law at the University of Sussex, argues that the proof-of-stake model is built on pre-existing inequalities, and as a result, “the people that make all the decisions are the people who are already very rich in the system.”

For art collectors, NFTs are typically treated as a speculative asset to be sold for a profit once its value increases, which in turn also benefits the artist if a commission is attached to the NFT. Secondary sales for established or “blue-chip” NFT artists such as Hackatal and XCOPY are contributing to a growing resale market that could sustain the NFT industry and prevent the NFT bubble from popping.

Conclusion

Regardless of whether the NFT art market can sustain itself in the near future, artists deserve more than the fleeting hype surrounding million-dollar sales and tech world opportunism. The art market has always been hard on artists, and the attention economy around NFTs is simply not enough to support overworked, sleep-deprived artists. NFT sites can start making the crypto-art landscape a more inclusive place that recognises artists’ hard work by upholding their responsibility to display information transparently and honestly.

Featured banner image from danky.art

Related Articles

The Woman Revitalising Australia’s Art Scene With Her All-Women Art Gallery

ColourSpace: The Social Enterprise Transforming Australia’s Offices into Art Galleries