The logistics industry will benefit from a substantial increase in B2C demand caused by the pandemic. E-commerce giants Alibaba and JD both reported 34% year-on-year increases in revenue earlier this month, caused by a surge in online shopping amidst lockdowns and increased social distancing measures.

The surge in e-commerce demand has boosted both companies’ logistics branches. Alibaba’s subsidiary Cainiao Logistics saw a 54% year-on-year increase in revenue in the most recent quarter, which amounted to RMB 7.7 billion (USD 1.1 billion). JD also saw their logistics and other services revenues increase by 54% YoY for the first half of 2020, coming up to RMB 15.4 billion (USD 2.2 billion). In fact, according to Savills’s mid-year regional roundup, “logistics volumes [in China] over the first half of 2020 accounted for 80% of 2019’s total.”

Traditional brick and mortar shops, restaurants, and grocery stores across the world are turning to e-commerce platforms and B2C fulfilment services to maintain their sales. FedEX reported “surges in residential delivers” that occurred in tandem with declines in commercial volumes in their fourth-quarter results earlier this year.

According to Savills, the pandemic has radically changed online consumer patterns: “COVID has also increased demand for e-commerce and pushed it into a broader range of products from (traditionally) fashion to groceries, medicines and other perishables. This shift is in turn driving demand for cold supply chains as well as last minute or urban logistics.”

The increased – and changed – demand could bode well for third-party logistics providers, many of which are now looking to fill the gap in the market amid declines in B2B demand. However, shifting to B2C logistics would require firms to pivot to fulfil a different set of business needs.

“A big demand from customers that is forcing the hand of logistics providers is to give real-time updates on the whereabouts of goods while in transit and speed up the digitalisation of logistic processes, from bookings and tracking to reporting,” Nick Bartlett, Director of Wayfindr, comments.

The digitalisation in logistics, while accelerated by COVID-19, is part and parcel of a broader cross-industry shift in digital infrastructure, which prioritises a seamless customer retail experience, whether online or offline. In addition, logistics providers are facing higher consumer expectations, with both Alibaba and JD offering express same-day deliveries for select goods, such as groceries and mobile phones, which arrive in a matter of hours.

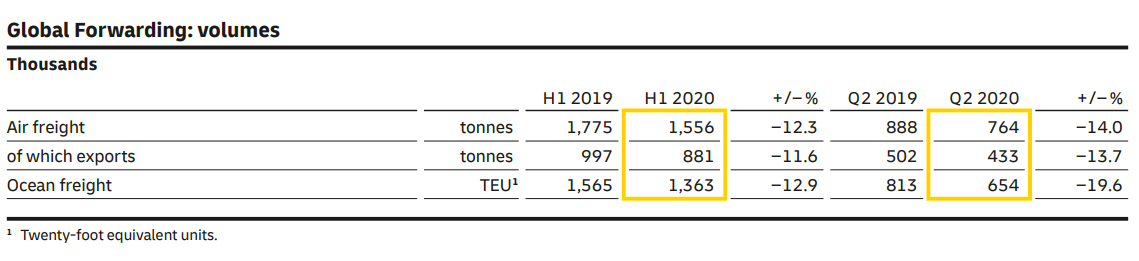

The industry has been hard-hit by supply chain disruptions earlier in the year due to COVID-19 lockdowns and travel restrictions. DHL reported a 12.3% decrease in air freight volumes as well as a decline of 12.9 % in ocean freight volumes in the first half of 2020.

DHL Freight Forwarding Volumes (Source)

Although jet fuel costs have declined, costs are also increasing across air and ocean services, especially as many ships are returning from the West to the East empty. In addition, port congestions have increased in LA, London, German and the Netherlands, caused by the resumption of exports from China.

Nonetheless, the industry remains resilient. Savills reports in its mid-year regional roundup, “Cap rates in this sector have moved in rapidly over the past five to ten years and protracted trade wars and COVID have done little to diminish enthusiasm.” The report highlights increased investor interest in Southeast Asia and India, given the rise of manufacturing industries there.

Logistics companies are more reserved in their outlook, with DHL noting both positive and negative impacts from COVID-19. “Despite COVID-19, our customers’ payment behaviour has so far not deteriorated significantly overall,” their report states. “However, we cannot rule out payment defaults caused by the pandemic in the future.”

FedEX has also declined to give an earnings forecast, citing the uncertainty surrounding the economic recovery timeframe.

Furthermore, the overall economic impact of the pandemic is likely to affect logistics volumes, with the global economy forecast to contract by 5.5% in 2020 and global trade to decline by 10.9%, according to figures from IHS Markit.

“It’s going to take a good amount of time for the logistics industry as a whole to recover its volumes back to pre-COVID,” Bartlett predicts. “Whilst there has been a surge with some industries, such as medical, from COVID-19, all major traditional manufacturers

Related Articles

Leading E-Sports Firm Razer Hits Record-High Revenues of USD 447.5M

Alibaba, JD Stocks Soar to Record Highs After Latest Quarterly Results