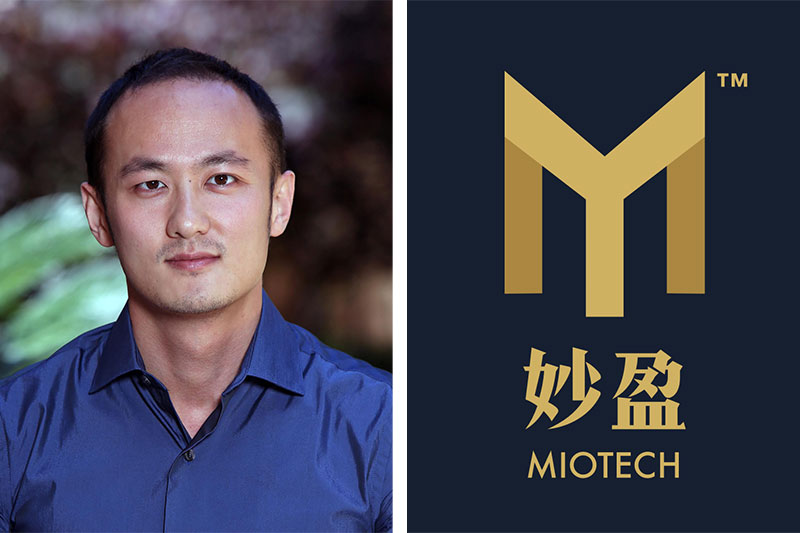

Built on the backbones of an unexpected friendship, FinTech firm MioTech is navigating a world of alternative risks – and how AI can help us thrive in it. CEO and co-founder Jason Tu sits down with Hive Life to explain how the landscape of success is changing.

When Jason Tu first met co-founder Tao Liu on a ski trip in Lake Tahoe, he did not anticipate their friendship blossoming into a multi-million dollar company that would be backed by one of Hong Kong’s biggest investors. Founded by the duo in 2016, MioTech is a FinTech firm that uses artificial intelligence (AI) to empower financial institutions to better manage risk, aiming to not only gather and process data but also take it one step further, analysing and building intelligence for financial institutions, investors and traders to understand the market better.

Born and raised in China, Jason has been around the globe. After graduating from Purdue University, he relocated to France where he received his master’s degree from the Toulouse School of Economics, eventually making his way to Hong Kong and America to work at Standard Chartered Bank, as well as at startups WeLab and RobinHood. After receiving his MBA from Stanford, he found his calling closer to home. “I started to realise that Asia had huge opportunities,” he explains. He was right. With the Greater China and Southeast Asia regions as its core focus, MioTech now has offices in Hong Kong, Shanghai, and a newly opened office in Singapore, with funding from Li Ka-Shing’s Horizons Ventures in Hong Kong as well as ZhenFund, a big angel fund in China.

MioTech, meaning millions of technology, aims to help companies manage unconventional risks by using artificial intelligence to collect and analyse data of all formats across different platforms. “The way that the general public values companies is changing. We’ve been paying attention to the market trends for a long time, and it’s time for alternative data providers to serve the market better,” Jason says. Alternative data, meaning data sets from different angles away from traditional financial statements, has become increasingly important for financial institutions to understand how they are performing. “The upcoming trend is that risks can come from all different aspects, like public sentiment, whether that’s from a piece of news, from social media, even from government policy or a series of butterfly effects,” Jason explains. With the growing trend of environmental awareness, he foresees that sustainable finance will play a big role in the future, with the younger generation focusing on whether certain kinds of data will prove that companies are being socially responsible.

You might also like The 7 Best Budgeting Apps in 2020

Although he hadn’t initially set out to be an entrepreneur, Jason has always been a visionary. “Honestly speaking, all I wanted to do is to make a difference,” he says. During his chance meeting with Tao, then a Silicon Valley software engineer, he became fascinated with Tao’s experience with ad bidding, which involved working with a large amount of AI. Wanting to make full use of this technology, the two began brainstorming, meeting at the Stanford library or at Jason’s dormitory to prototype products. ”We started to realise that the current direction that we were working on, especially on alternative data, alternative risks and sustainable finance, was a very good direction,” Jason recalls. “Long story short, we met in Silicon Valley on a ski trip, and it’s all about friendship,” he says. “Startups are all about getting the right people – people that you trust and will also trust you.”

At its inception, the team consisted of five engineers and designers, all of whom were Jason’s friends from his days in Silicon Valley. What he saw as the most important asset to his company, however, also proved to be its greatest challenge as he learned to navigate between recruiting, managing and, toughest of all, letting talent go. “The most difficult part is having difficult conversations,” he says. “Everyone is talented in one way or the other, but not everyone is suitable for a particular position.” He recalls one of his first firing cases where the conversation did not go well. “He said, ‘I can’t believe that you graduated from Stanford.’ Out of nowhere. I was like, ‘How does it relate to Stanford?’” Jason laughs. “But now we’ve become very good friends. Now he understands where I came from.”

Jason’s amiability proved to be one of his greatest assets when securing funding. He recalls speaking with a friend who had pitched over a dozen venture capitalists per week, whereas he’d pitched to around six investors in total. His secret to success? The close friendships he had formed with them over several years. “I’m a different kind of founder where I focus less on pitching, more on relationships,” he says. “Some of the fundraising strategies are more like speed dating, but for me, I prefer long-term relationships until it reaches a point where both sides figure out it’s the right time to enter into the next stage.”

Currently, MioTech provides services to over 50 large financial institutions. Anticipating that AI will play a large role in the future, Jason hopes MioTech will continue to grow, becoming part of an industry standard and attracting as many clients from different groups as possible. “Once you have the technology, you have the data,” he explains. “And, once most of the players in the market use your data and recognise you as someone who has the authority, you can become an industry standard.“ To budding entrepreneurs, he offers this advice: “You’ve got to be prepared for failure and you’ve got to be prepared to learn,” he says. “Just try it out. The world is big; learn as many things and work on many things as possible.”

Related Articles

Payment Giant Stripe Talks About Future of the Internet Economy

8 FinTech Apps To Streamline Your Personal Finances

The CEO Going The Extra Mile, From FinTech to Ultramarathons